Apr 18, 2024

Caputo Speech At JPMorgan Event Helps Propel Argentine Bonds

, Bloomberg News

(Bloomberg) -- Argentina’s Economy Minister Luis Caputo told investors that President Javier Milei is committed to a dramatic fiscal adjustment, helping fuel a rally in the nation’s bonds late on Wednesday.

Caputo’s comments were made at a private seminar led by JPMorgan Chase & Co. during the International Monetary Fund’s spring meetings in Washington, and preceded a fireside chat between investors present and bank CEO Jamie Dimon.

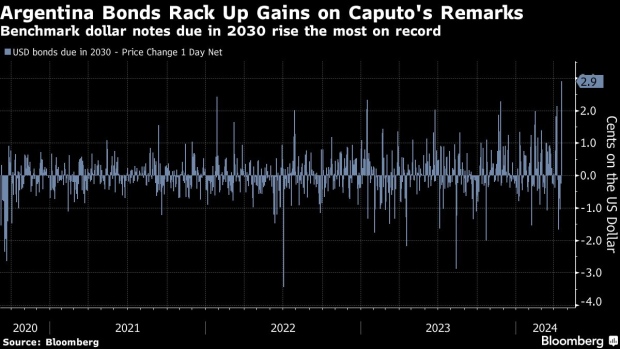

Benchmark dollar bonds due in 2030 rose 2.9 cents to trade at about 56 cents on the dollar, according to data compiled by Bloomberg. The move is the biggest one-day jump since the notes were issued in 2020. It was the best performance in emerging market debt, which largely rebounded from a massive selloff earlier in the week.

Caputo told his audience that Argentina’s fiscal adjustment is bigger than is generally understood locally, according to two people in attendance, who asked not to be named since the event was private. The process involves more “chainsaw”, the symbol for slashing a bloated budget, than “blender”, the process of cutting costs by not raising wages and pensions in line with inflation, Caputo said, according to the people.

Capital Controls

Argentina won’t lift capital controls until international reserves are high enough to safeguard against a potential currency run, Caputo told investors. Milei has previously said the unwinding of these controls, a key step in Argentina’s reintegration to global capital markets, must be preceded by a clean-up of the central bank’s balance sheet and a reform of the financial system.

Read More: Milei Sees Long Slog Ahead to Deliver Reforms in Argentina

On Wednesday, Milei’s government sent a new version of its fiscal reform bill — which would expand the income tax base and encourage the declaration of Argentine assets abroad — to congress. His sweeping omnibus bill, that would expand his executive powers and privatize some state companies, is pending reintroduction after it failed to pass in February.

Investors have expressed concern about the government’s weakness in congress, where Milei’s party holds 15% of seats, but Caputo sounded confident that they would hit their fiscal targets with or without the bill’s approval, according to one of the people.

In four months in office, Caputo has achieved fiscal surpluses in January and February, something not seen in the South American economy in over a decade. Monthly inflation cooled for three consecutive months, though annual rates remain close to 300%. Milei’s shock therapy has hit consumption, and the economy is forecast to suffer a sharp recession this year.

Read More: Argentina Cuts Rates to 70% as Markets See Inflation Easing

Caputo and Central Bank President Santiago Bausili are expected to hold talks in Washington with IMF and US Treasury Department officials. Milei’s government has said it doesn’t rule out the possibility of requesting a new program with the Fund, with fresh funds in order to exit capital controls.

--With assistance from Manuela Tobias and Kevin Simauchi.

©2024 Bloomberg L.P.