Apr 26, 2024

Citi, JPMorgan See Carry Trade Revival as Fed Hawkisness Spreads

, Bloomberg News

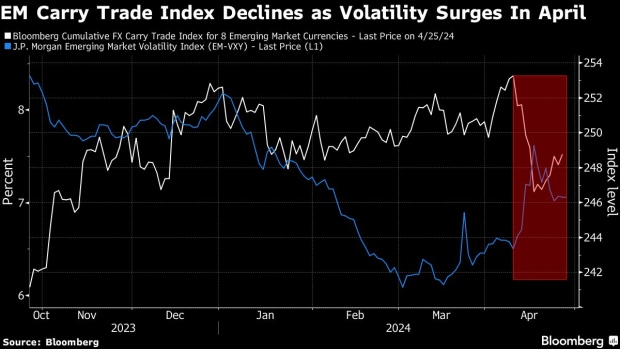

(Bloomberg) -- Emerging-market currencies will be attractive for carry traders as hawkishness has been spreading from the Federal Reserve to many developing central banks, according to strategists from Citigroup Inc. and JPMorgan Chase & Co.

“We have made the case in the past that emerging-market carry was historically high but would likely have normalized by mid-2024. This now looks less likely, keeping the carry baskets more attractive,” Citi strategists including Dirk Willer said in a report. “Hawkishness has been spreading from the Fed to many EM central banks, which is not atypical in a strong dollar environment.”

The clearest move came from the central bank of Brazil, they said, adding that the monetary authority removed guidance for a 50 basis-point cut in interest rates and suggested a slowdown in easing instead. “But it was not just Brazil. Even central banks in central and eastern European countries, which could and maybe should rely more on the ECB, were aligning their speeches more with the increased caution from the Fed, rather than the more dovish ECB language.”

Read more: Brazil’s Revised Rate Outlook Is Symptomatic of Malaise

In a surprise move this week, Indonesia raised its benchmark interest rate to a record high. The hike could set the tone for other emerging Asia central banks that are having to ramp up their currency defenses while waiting for the Fed to begin its easing pivot.

After US data this week pushed traders to trim their bets for US rate cuts, swaps traders now see only about 33 basis points of Fed rate reductions for all of 2024, well below the more than six quarter-point reductions they expected at the start of the year.

JPMorgan analysts also said carry remained significant in emerging markets and was a key factor differentiating currency performance.

“Emerging-market FX is getting more attractive as our risk appetite index is signaling oversold conditions,” strategists including Jonny Goulden wrote in a report. “The current environment is not a bad one for bullish EM FX views.”

©2024 Bloomberg L.P.