Sep 20, 2017

Entrepreneurs divided over Morneau's tax plan: Poll

, BNN Bloomberg

Entrepreneurs in Canada are divided on Finance Minister Bill Morneau’s plan to tighten tax rules for private corporations, according to a new poll by the Angus Reid Institute.

The online survey, conducted in partnership with MARU/Matchbox, polled 852 small business owners and 1,139 non-owners from Sept. 13-18.

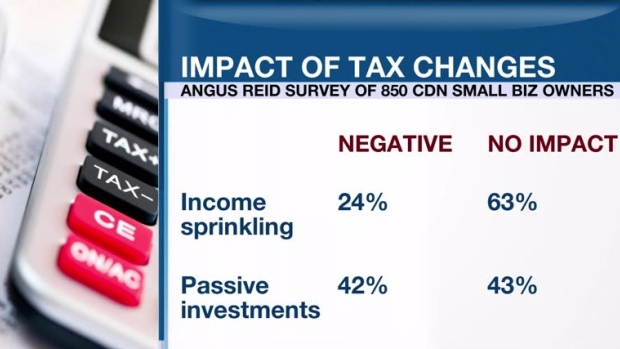

Forty-three per cent of small business owners surveyed said the changes dealing with passive investment would have no impact on their business, while 42 per cent say there would be a negative effect. The perceived negative impact from the proposed measures was higher for business owners with five or more employees (55 per cent), while business owners with fewer employees were less likely to expect a negative impact.

When it comes to the clampdown on so-called income sprinkling, there was less of a divide, with two-thirds of small business owners saying they will feel no impact, while one-quarter see the potential changes having a negative impact.

The overwhelming majority of business owners surveyed (84 per cent) agree that people starting a new business deserve ongoing tax breaks to help offset their financial risks.

Half of respondents who don’t own a business say the changes, if implemented, would harm business investment, while the other half say these changes will make the tax system fairer and should be implemented even if some groups protest. However, support for the proposed changes decreased among respondents who work for a small business or who have a family member working for a small business.

Breaking the findings down regionally, British Columbia and Quebec were the only two provinces where respondents had majority support for the tax changes overall. Alberta was the province with the least support for the proposed reform.

Editor's Note: The Angus Reid Institute poll shows 50 per cent of Canadian non-business owners believe the government's proposals will make the tax system more fair. An earlier version of this story included video with incorrect information. BNN regrets the error.