Nov 6, 2017

Erin Gibbs' Top Picks: November 6, 2017

BNN Bloomberg

Erin Gibbs, vice president of S&P Global Market Intelligence

FOCUS: U.S. equities

______________________________________________________________

MARKET OUTLOOK

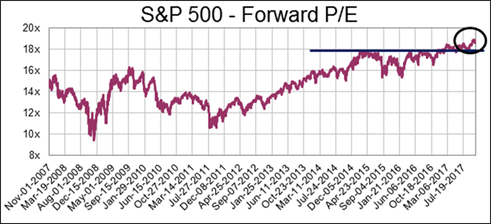

We are concerned by the high valuations of the U.S. stock market, but until there is any fundamental weakness or a significant increase in interest rates, the U.S. stock market remains one of the most attractive assets. Peak valuations of almost 19x forward earnings of the S&P 500 are not justified purely by earnings and revenues, but rather because investors have a lack of attractive options as long as interest rates remain depressed.

While the Federal Reserve looks increasingly likely to raise rates in December, it will still be a small 25 bps raise. And the yield curve has remained stubbornly flat, giving investors little reason to move assets from stocks to high yield.

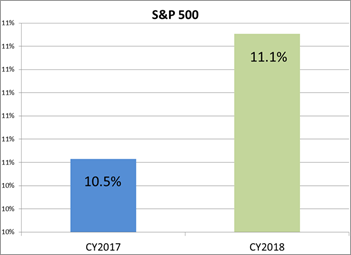

Also fueling the stock market optimism is another stellar earnings season. Over 2/e of the S&P 500 companies have reported third quarter earnings. Expectations for Q3 went from about four per cent profit growth to six per cent, along with steady improvements to expectations for this year. The S&P 500 is now expected to have EPS growth of 10.5 per cent for 2017 - quite an improvement over the almost zero growth we saw last year.

Still, two years of consecutive double digit earnings growth is a solid signal for the U.S. equity markets.

TOP PICKS

VULCAN MATERIALS (VMC.N) - purchased 6/26/2017, at about US$133.48.

Vulcan is expected to see double digit earnings growth for both this calendar year and 2018, mainly from large highway projects. There is a steady recovery in non-residential construction, and better visibility for infrastructure projects. Margins are expected to expand over the next 18 months along with earnings.

ULTA BEAUTY (ULTA.O) - purchased 9/1/2017, at about US$221.73.

Ulta Beauty is included in our Competitive Advantage strategy that looks for companies with attractive return on invested capital along with reasonable valuations. Ulta Beauty meets both these criteria. Ulta is expected to open 100 stores for its fiscal 2018 year, to attain 28 per cent expected EPS growth and 21 per cent revenue growth. Ulta is expected to increase capital spending for improvements in its stores, including prestige brand boutiques and the Ulta Beauty collection and fragrance fixtures.

DELTA AIR LINES (DAL.N) - purchased 3/1/2017, at about US$51.03.

Delta has attractive free cash flow yield along with a recovery in expected EPS growth for 2018. While 2017 showed a decline in earnings, 2018 expectations are for 11 per cent EPS growth and a recovery in revenue growth. Air travel demand is expected to increase over the next year on the recovering global economies. Delta has stood out with strong free cash flows relative to peers.

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| VMC | N | N | Y |

| ULTA | N | N | Y |

| DAL | N | N | Y |

PAST PICKS: JANUARY 30, 2017

SOUTHWEST AIRLINES (LUV.N)

Strong return on invested capital with attractive valuations. Despite some disruptions of travel from the hurricanes, Southwest reported upbeat earnings and revenue growth for Q3. Price competition is still fierce but expect increased capacity along with revenue synergies from adding frequencies and connections to markets.

- Then: $52.35

- Now: $55.01

- Return: 5.08%

- Total return: 5.72%

MACY'S (M.N)

While department stores may struggle for the next 12 to 24 months as they compete with Amazon, Macy’s has been more proactive than others in moving to online sales and reducing its legacy store count as part of the planned closure of 100 stores. There is potential for monetization or re-purposing some of Macy's assets via its partnership with Brookfield Asset Management. Attractive free cash flow yield and exceptional seven per cent dividend yield.

- Then: $29.52

- Now: $18.25

- Return: -38.17%

- Total return: -35.26%

APPLE (AAPL.O)

Attractive free cash flow yield, through recent appreciation since the end of October (after announcements and iPhone X sales have started) have made it a less attractive entry point.

- Then: $121.63

- Now: $174.64

- Return: 43.58%

- Total return: 45.37%

TOTAL RETURN AVERAGE: 5.27%

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| LUV | N | N | Y |

| M | N | N | Y |

| AAPL | N | N | Y |

TWITTER: @gibbserin

WEBSITE: www.spglobal.com