May 19, 2017

Gas prices won't be affected by OPEC's 'huffing and puffing': Petroleum analyst

, BNN Bloomberg

Canadians experiencing pain at the gas pumps shouldn’t look to OPEC to bring down prices anytime soon, according to the chief petroleum analyst at En-Pro International.

“I think we should just forget about OPEC and their huffing and puffing,” Roger McKnight chief petroleum analyst at En-Pro International told BNN on Friday. “They can extend their cuts to 2020 if they want to.”

“What I look at is gasoline demand, distillate demand and inventories. Crude inventories are swelling and they ain’t going to get any better.”

Oil prices are set for their second week of gains on growing expectations that OPEC and other oil exporters will extend output cuts to curb a persistent glut in global inventories.

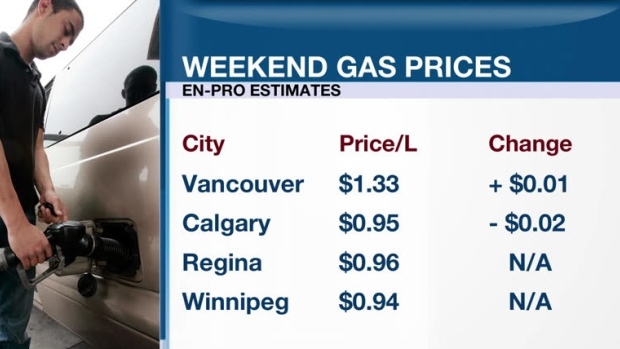

Gas prices generally track the price of oil but higher supply and lower demand are keeping prices under pressure heading into the long weekend. Halifax is seeing a three-cent decrease in prices at the pump to lead the country’s major cities.

McKnight said Canadian prices are much more closely tied to U.S. competition than anything driving the global crude oil market.

“Prices in Canada follow whatever happens in the United States, and as far as central Canada is concerned, I can’t see much happening at all,” he told BNN.

“I think we reached our peak about a week ago. The inventories of gasoline in the United States are above the upper limits and demand is still down about 2.6 per cent,” he said. “It’s all looking pretty good for the long weekend and for the short-term throughout North America.”