May 15, 2017

Home Capital shares rise as accounts stabilize for first time since crisis began

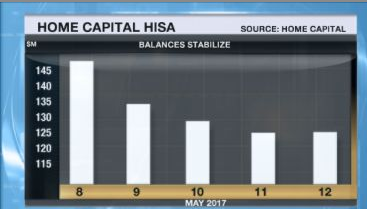

For the first time since the liquidity crisis struck Home Capital Group (HCG.TO), the company is posting a stabilization of its high interest savings account (HISA) balance. In a release early Monday, the beleaguered mortgage lender said HISAs were steady at $125.4 million on Friday, May 12, after weeks of outflows that resulted in the balance declining nearly 95 per cent from the $2 billion on the books in late March.

Shares in Home Capital rose Monday morning at the market open. They were trading up more than six per cent as of 12:05 p.m. ET.

Home Capital also reported modest declines in its guaranteed investment certificate (GIC) balance, though those accounts are almost entirely fixed-term agreements that cannot be pulled before maturity. On the company’s first-quarter conference call Friday, Home Capital executives said about $400 million of the $800 million of cashable GICs had been pulled by customers.

The company also announced it has not been forced to draw further funds from its $2-billion line of credit with the Healthcare of Ontario Pension Plan (HOOPP), with Home Capital retaining $600 million worth of breathing room on the facility.

In an interview on BNN Friday, Home Capital Chair Brenda Eprile said the company’s top priority is finding a lower-cost replacement for the facility, which carries an interest rate of 10 per cent on drawn funds, and a standby fee of 2.5 per cent on any cash the company doesn’t use. Eprile said the pact with HOOPP was the best available for the company on short notice, though there were other interested suitors.