Dec 18, 2017

Housing, rates, bitcoin and more: Larry Berman's 2018 market outlook

By Larry Berman

The tradition on Berman’s Call has been for me to use the last show of the year to forecast what I expect for 2018. Let me start off by saying, I could not have been more wrong about 2017. So as I always say, don’t just take what I say and make that your portfolio outlook.

I played 2017 with my foot over the brake. In the largest of the three sleep-at-night portfolios I manage for Bank of Montreal - the Tactical Dividend ETF Fund - the year-to-date gross returns of 8.9 per cent with standard deviation (risk) of 6.3 per cent was good. In these funds I target a Sharpe Ratio (a key measure of risk adjusted returns) above 1.

In the long run, I focus on delivering the highest return possible with the lowest amount of risk… One reason why bitcoin would not likely be in my portfolio anytime soon or maybe ever. That does not mean it won’t double or triple in price in 2018, but the risk factors are too high for a conservative portfolio manager like I am. And, it doesn’t change my view that it’s a bubble that will end badly for many.

Looking out at 2018, I see little reason to step on the portfolio gas. Late in the business cycle is one of the toughest periods to be a value investor. It clearly favours the momentum (growth) investor until the bull market ends.

Expectations typically suggest that with central banks in tightening mode, labour markets tight, we will see wage pressures and some inflation. Commodity-type markets tend to perform best late in the cycle. This argues that a commodity rich index like the TSX should do well.

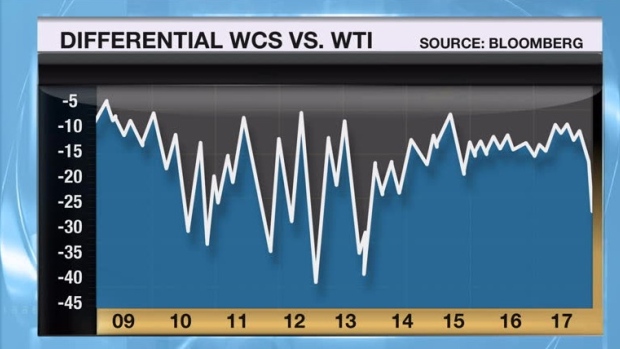

However, Canada has a few major risks that suggest it may not. The major one is that when Western Canadian Select trades at a big discount to West Texas Intermediate, the 20-per-cent-plus energy sector of the S&P/TSX composite index tends to underperform. We have started to see this play out in a big way in recent weeks. The lack of pipeline capacity to get our landlocked oil and gas to market is a major negative for Canada. We do not see that changing anytime soon.

The other major issue is rising rates and real estate. Real estate has been the single biggest positive in recent years for Canada’s GDP (outside of government deficits). We see Canadian rates moving up with U.S. rates in 2018 unless NAFTA is broken by the Trump administration, which we expect we will see in 2018. Look for the S&P/TSX to underperform on a few fronts. A weaker Canadian dollar is also in the cards and we could see it averaging closer to 75 cents in 2018, especially if NAFTA is broken before it is fixed.

On valuation, emerging markets and Europe are much more attractive than the U.S. market, but carry higher volatility risks. Adding exposure to these markets on weakness is the preferred strategy. I do not expect a recession in 2018, the U.S. tax package will likely prevent that. However, I do think we get a sell-the-news impact when the tax bill is passed.

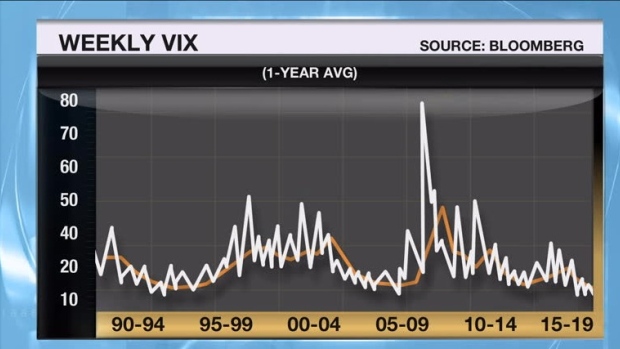

Talk of an infrastructure bill for 2018-19 may keep the excitement going well into 2018. The degree that the unwinding of the Fed’s (and other central bank) fat balance sheets along with rate hikes slows the real economy is a market risk in the back half of 2018 for sure. We should see a 5-10 per cent dip at some point in the first half of 2018, keeping in mind that such a move is quite normal and probably healthy at this point. In fact, 2017 was an anomaly, in terms of low volatility. We are now in the lowest volatility period in decades. Expect volatility to pick up as the Fed and other central banks reduce liquidity.

Wishing all BNN viewers a happy and healthy 2018.

Follow Larry Online:

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com