Apr 7, 2017

How the U.S. could sway a Canada-China trade deal

, BNN Bloomberg

U.S. President Donald Trump held his first face-to-face meeting with Chinese President Xi Jinping in Florida this week – a summit closely watched by investors and business leaders around the world.

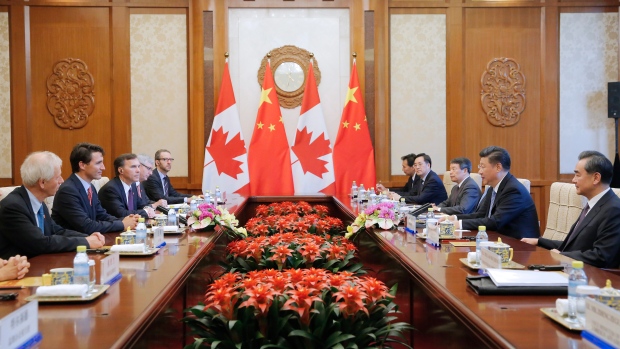

While China is a key relationship for the U.S., it’s one Canada has recently shifted more of its attention to, as well. Prime Minister Justin Trudeau met with the Chinese leader in August, and Canada had its first round of exploratory trade talks with the country earlier this year.

But there’s little doubt among analysts that the state of the relationship between China and the U.S. will have an impact on Canada.

“China and the U.S., as two world superpowers, will always have a fraught but important relationship,” Sarah Kutulakos, executive director of Canada China Business Council, told BNN in an interview. “They are mutually dependent on each other in many ways. Canada needs strong relationships with each, and as a middle power, Canada has unique characteristics.”

Charles Burton, an associate professor of political science at Brock University, who formerly served as a counsellor at the Canadian Embassy to China, said Canada is likely taking a wait-and-see approach with China.

“Certainly everyone’s waiting to see what happens with Trump,” he told BNN in an interview. “If relations with the United States started to deteriorate, [the Chinese government] might be willing to give us more favourable terms for free-trade agreements.”

“I think it’s still early days,” Burton added. “The conditions of China in other geopolitical trade situations could seriously impinge our ability to negotiate our agreement bilaterally with China.”

Canada’s largest trade partner is the U.S., but Burton said China should be the next big focus for Canada. China is currently Canada’s tenth-largest trading partner, according to Statistics Canada.

DEFINING WHAT WE WANT

Kutulakos said the most important step for Canada when it sits at the negotiating table with China is to define exactly what it wants from a free-trade agreement.

“What are the economic benefits that a [free-trade agreement] will bring? And what will the future bring in terms of growth in sectors that may not be a big part of our global trade today?,” she said.

Kutulakos added it would be important to determine where we are behind when compared to competitors like Australia and New Zealand – countries that already have free-trade agreements with China.

“Commodities like barley and coal now have tariff disadvantages [for Canada] versus Australia. In relatively short order, we could have a stage-one agreement that basically brings us to parity,” Kutulakos said.

A LEVEL PLAYING FIELD

Burton said there’s a number of considerations Canada should bring to the negotiating table with China.

“Can we actually get access to the Chinese market on a level playing field? Is China prepared to remove the non-tariff barriers to trade that currently exists? And are they able to allay Canadian investors’ concerns about infringement on copyright, on proprietary manufacturing processes?” he said.

“Then there’s the question of standardization of [trade] standards,” he added, using the example of China almost halting Canadian canola exports last year.

Both Kutulakos and Burton agree that aspects of trade agreements between the two countries could take several years to negotiate. Australia’s agreement with China took nearly a decade to finalize, and it took seven years of negotiations before Canada and the European Union signed the Comprehensive-Europe Trade Agreement (CETA).

Kutulakos noted the China-Canada relationship has been inconsistent for many years, and that a free trade agreement was not a priority for the Canadian government.

“Prime Minister Trudeau has made a more consistent relationship a priority, and we should see much more progress on many aspects of the bilateral relationship going forward,” she said.

But Kutulakos warned that Canada needs to look at when the window will close on certain sectors.

“China is changing at a very rapid pace,” Kutulakos said. “The market opportunity for a sector today my look very different in five years.”

Burton echoed Kutulakos’s sentiment, noting the mounting domestic pressure for Canada to come a trade agreement with China.

“There’s domestic pressure from inside Canada from businesses who have potential to do business inside China—particularly ones who have already been popular there like Bombardier and SNC-Lavalin,” he said.

A second round of exploratory talks between China and Canada is expected later this month.