Apr 24, 2024

Italy’s Superbonus-Stoked Debt Draws Fitch’s Attention

, Bloomberg News

(Bloomberg) -- Italy’s return to a trajectory of rising debt risks complicating the task of managing the euro zone’s third-biggest economy and could stoke political tensions, according to Fitch Ratings.

In a report released late on Tuesday, the credit-assessment company highlighted how the shift reflects much stronger-than-expected take-up of so-called “superbonus” tax credits to finance home renovations — a pandemic-era measure instituted by the government of Giuseppe Conte.

That plan was inherited by Premier Giorgia Meloni’s coalition, whose push to limit its scope will at least curb take-up “significantly,” Fitch analyst Malgorzata Wegner wrote, while cautioning that the legacy will still be felt over the next decade.

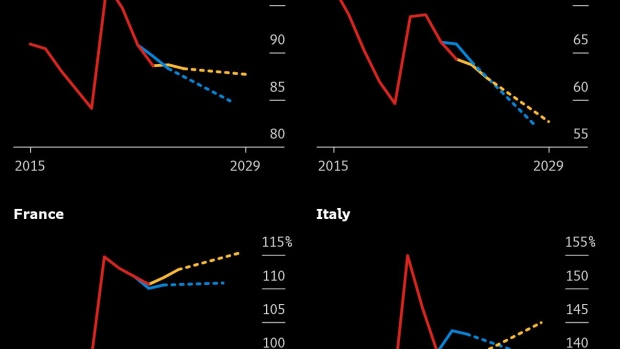

The country’s worsening public-finance position was reflected in forecasts from the International Monetary Fund last week, which showed debt as a percentage of gross domestic product breaching 140% again in 2025 and rising every year after that.

Fitch is scheduled to release a possible assessment of the country on May 3. It currently grades Italy as BBB — two steps above junk — with a stable outlook. The judgment is on a par with that of S&P Ratings, which last week kept its verdict unchanged in the first major credit scrutiny since the government revealed a worsened debt path this month.

Fitch acknowledged that Italy’s borrowings have turned out to be much lower than expected because of investment. Superbonus-related spending in advance of a deadline at the end of last year will probably lead to an upward revision to growth in the fourth quarter, Wegner said.

Rating Review Schedule

She warned that the prospect of rising debt and looming pressure from the European Union to fix the public finances could lead to strife in Meloni’s governing alliance.

“Reduced fiscal space might complicate fiscal and economic policymaking and increase tensions within the coalition government,” she wrote.

(Updates with rating calendar after sixth paragraph. An earlier version corrected debt level.)

©2024 Bloomberg L.P.