Jan 29, 2018

Larry Berman: End of the 38-year bull market? More like a cyclical bump

By Larry Berman

Several major players in the bond world have called an end to the 38-year bull market. Far be it for me to disagree with the likes of Bill Gross, Jeff Gundlach, Ray Dalio and others, but I think we are likely seeing a cyclical bump, not a secular shift in the interest rate outlook. There is no doubt rates will rise in 2018 led by the U.S. Federal Reserve, but when the next recession hits, I believe there will be even more quantitative easing (i.e. buying bonds) to suppress longer-term interest rates, along with the likelihood for negative interest rates like we see now in Japan and Europe. I know it’s hard to think about a recession when things are seemingly booming, but such goes the economic cycle. Historically, rising rates tend to kill economic momentum and lead to recessions.

Inflation has generally been declining for 37 years. What caused this secular deflationary shift and why would it be ending now? The biggest deflationary force, in my humble opinion, has got to be from technology and the invention of the ever shrinking and ever faster microchip. And while the chip speed is not accelerating at the same pace it has been, it’s still accelerating. This is opening the door for new technologies like artificial intelligence and robotics that will likely continue the deflationary trends, especially related to employment and jobs that can be replaced by these technologies. Most experts believe that these technologies will provide a net loss of jobs. The most obvious seems to be in autonomous vehicles. We do not see an end to technological advancement.

The second biggest deflationary force has to be demographics, though if you argued that was the most important factor, I would not push back too hard. There are now more people taking money out of Social Security programs in the U.S. than are paying into them. Society is aging rapidly, and life expectancies are generally increasing. When you hit the age of 60, you think about your retirement years and your savings that need to last possibly 20 to 30 more years when you’re not going to be working. So, you shop more at Amazon and Priceline than you do at traditional retailers to save a few dollars. The level of interest rates does not stimulate consumption like it did when you were 30 and considered buying a bigger home when rates fell. Demographics in a large part drive the behaviour of aggregate demand. The demographic trends are very deflationary in most of the developed world and China. Sub-Saharan Africa, India, and parts of the Middle East have very young populations and will offer boomer type growth like we used to see in the developed world.

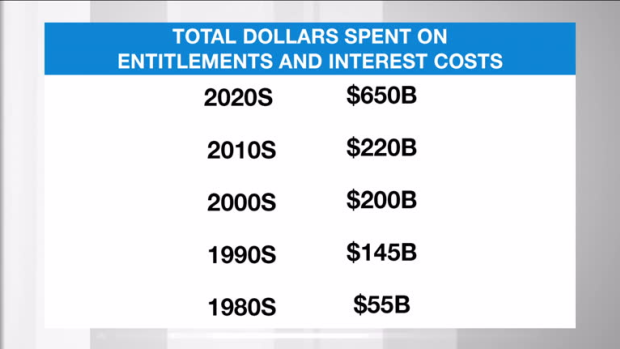

And finally, the level of outstanding debt that has accumulated – specifically in the post-financial crisis era – is staggering. The interest payments on U.S. national debt, according to the Office of Management and Budget, is set to rise rapidly. Interest costs (of existing debt) and Entitlements are up to 62 per cent of spending in 2017, according to the Congressional Budget Office. They estimate it will be 100 per cent by about 2030 – that is, 100 per cent of tax dollars received will be paid out just for interest costs and entitlements. Not one federal employee would be paid and no discretionary spending, unless that money is borrowed. We can’t see an economy being able to fund materially-higher interest rates in this scenario.

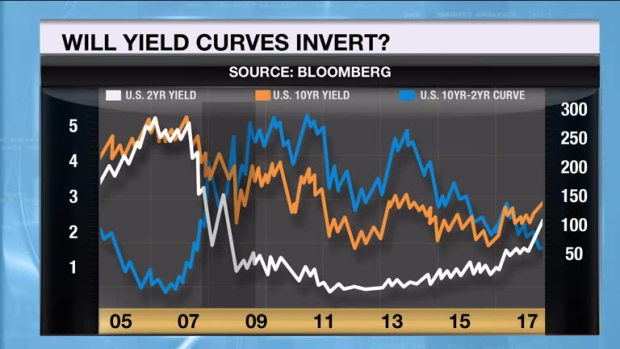

The Fed is expected to raise rates three or four times in 2018 and some have commented that the new Federal Reserve Chair Jerome Powell is no Janet Yellen. Listening to his comments over the years, he does not like QE and is very wary of asset type bubbles where his predecessors, Ben Bernanke and Yellen, were “game on” for asset bubbles driving trickle-down economics. If they continue on this path, there is a good case for the U.S. two-year vs. 10-year yield curve to invert like it did in 2006. Back in 2006, both the two-year and 10-year bond yields were about five per cent. A five-per-cent yield today with double the debt, would likely put the breaks on economic growth.

Having a balanced portfolio is pretty important to help smooth out the difficult periods for equities. With bond yields at extremely low levels and rising, it’s going to be tough to get the same type of protection in your portfolio from bonds with yields on the rise. There are important lessons to learn about the 2008 to 2009 period that may help you weather the next recession. The yield curve is suggesting that could be a 2019 story.

My upcoming speaking tour will focus on how to teach investors to navigate their portfolios in a period of rising rates and potential recession. Register for free at www.etfcm.com. BNN viewers can make a voluntary charitable donation to support Alzheimer’s research at Baycrest Hospital and Cancer research at the Hospital for Sick Children.

Follow Larry online:

Twitter: @LarryBermanETF

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com