Mar 26, 2018

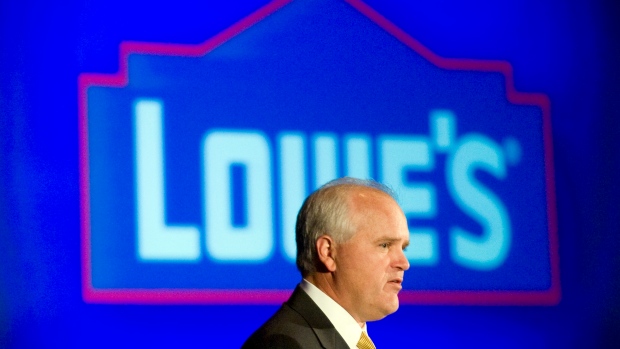

Lowe's searches for new CEO as Robert Niblock plans retirement

, Bloomberg News

Lowe’s Cos., under pressure to match the performance of Home Depot Inc., is looking for new leadership after its long-time chairman and chief executive officer announced plans to retire.

Robert Niblock, a 25-year veteran of the home-improvement retailer, will remain with the company in his current roles until a successor is found, the company said Monday. He has served as CEO for 13 years. Lowe’s shares jumped the most in more than a year on Monday.

Niblock, 55, is stepping down at a time when activist investor D.E. Shaw & Co. has pushed Lowe’s to close the gap with Home Depot. While sales at Lowe’s have risen, they continue to trail gains at its larger competitor as property values rise and Americans invest more in their homes.

“The market is likely excited for new leadership,” said Seema Shah, an analyst at Bloomberg Intelligence. “It is hoping for a leader who can better capitalize on the macro tailwinds and drive improved bottom-line performance.”

Part of Lowe’s struggle is the chain has fewer stores in lucrative areas than Home Depot. Niblock said last month that the company is boosting capital spending by about 50 percent this year, and working to have employees spend more time with customers.

Shares of Lowe’s surged as much as 7.8 per cent to US$90.33, the biggest intraday gain since March 1, 2017. They had dropped 9.9 per cent this year through Friday’s close.

ACTIVIST CRITICISM

Lowe’s said in January it would appoint three new directors to its board after D.E. Shaw took an active stake in the company worth about US$1 billion, people familiar with the matter said at the time.

D.E. Shaw believes Lowe’s is underperforming Home Depot and could triple its value if it were to focus on improving sales, including its online offerings and marketing, the people said. Higher shipping costs than Home Depot and a less flexible labor structure are also contributing to the gap in value, they said.

Among the nominees for Lowe’s board was David Batchelder, co-founder of Relational Investors, who also sat on Home Depot’s board between 2007 and 2011 when the when that company underwent a dramatic transformation, including removing the CEO and several new directors.

The board’s search committee will be led by Batchelder, Lowe’s said in a separate email. The committee will also include Rick Dreiling, Angela Braly, Eric Wiseman, Bertram Scott and Lisa Wardell.

'EXCELLENT CONDITION'

“We applaud Robert for his successful career with Lowe’s, which was dedicated to serving customers, empowering associates and delivering returns to shareholders,” said Quentin Koffey, a portfolio manager at the D. E. Shaw group. “Robert leaves Lowe’s in excellent condition to execute on the tremendous value creation opportunities ahead of the company. We wish him well in his retirement.”

While Lowe’s shares have dropped in recent months, their value has still more than tripled in value since Niblock took over as CEO and chairman in 2005. However, Home Depot shares have more than quadrupled over the same period.

Under Niblock’s tenure as CEO, Lowe’s store count almost doubled to 2,152.

To replace him, Lowe’s is likely to look outside the company, said David Schick, director of research for Consumer Edge Research. A “fresh set of eyes” would be good in an industry that’s been upended by online shopping, he said.

--With assistance from Scott Deveau and Matt Townsend