Dec 8, 2016

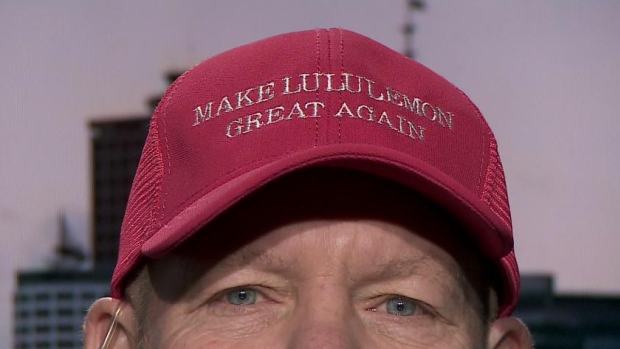

'Make Lululemon Great Again': Chip Wilson says retailer can be US$20-billion company

, BNN Bloomberg

Lululemon Athletica founder Chip Wilson says the retailer is still a “very, very good company” but called for a change in how the yoga and leisure apparel company is seen in the world.

“I’m always fascinated by how the media and the public go the Lululemon stock has gone up nine, 10, 11 per cent over the year – or even 20 now,” Wilson said in an interview with BNN, while wearing a custom-made “Make Lululemon Great Again” hat.

“We have to look at it over a long period of time. The stock market has done amazing things in the last three years. Lululemon is just in the recovery stage now.”

Wilson also said Lululemon’s leadership needs to pivot its strategy, which can help it make it a US$20-billion company – versus its current status as a nearly US$10-billion retailer today.

“We have the ability to take ourselves out of the competition and increase the margins and make Lululmeon a $20-billion company quicker than what it is,” he said.

The company has recently struggled with in-store traffic, but Wilson said he looks at the company in a greater context, boasting its e-commerce and logistics side of the business.

“I look at it from does it have a big vision and is it taking itself out of the competitive market as opposed to being one of many.”

“I’m looking at it and I’m the biggest cheerleader for it,” he said, adding that the company has the opportunity to “recreate” themselves.

The Vancouver-based company reported its third-quarter earnings Wednesday, topping analyst's profit expectations. Lululemon shares surged more than 17 per cent in Thursday trading.

Wilson has been known to criticize the leadership and management of Lululemon. In an interview on BNN in September, Wilson said that he had not spoken with current CEO Laurent Potdevin and that Potdevin did not want to follow Wilson’s “winning formula” for Lululemon.