Feb 15, 2018

Morneau needs to address tax competitiveness in federal budget: Rosenberg

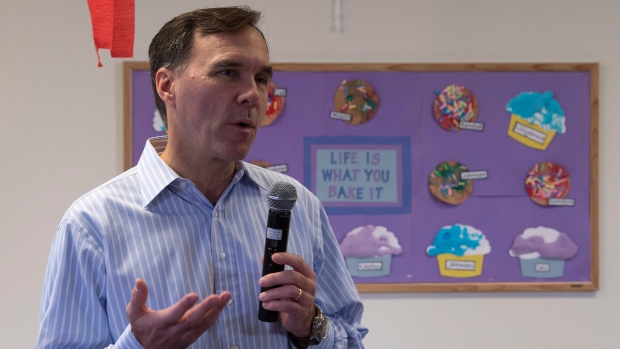

Federal Finance Minister Bill Morneau needs to worry less about perceived tax fairness and more about global tax competitiveness in the upcoming federal budget, according to David Rosenberg, chief economist and strategist at Gluskin Sheff + Associates.

“I am willing to wait until February 27th to be corrected on this, but we have a federal government that seems to be more bent on social justice and tax fairness than on export competitiveness and a more competitive tax regime,” Rosenberg said in an interview Thursday on BNN.

On Tuesday, Morneau announced the Feb. 27 as the date of his third budget. The budget will reportedly include funding for pay-equity legislation for employees in the federal government and federally-regulated sectors.

Ottawa is not expected to address taxes in the new budget despite large tax cuts recently implemented by the U.S. and other countries that undermine Canadian tax competitiveness, said Rosenberg.

“The world is moving towards lower-tax regimes. Even [Emmanuel] Macron in France is catching on to legislative changes and tax reform that are going to boost French competitiveness,” he said. “I really don’t get a sense in Ottawa that that is a priority.”

The lack of tax competitiveness – along with continued uncertainty about the future of the North American Free Trade Agreement – will continue to be a drag on business investment in Canada, Rosenberg said.

“These talks just get elongated; it adds to the uncertainty and capital spending plans get shelved – at least for the first half of the year,” he said.

With Morneau appearing unwilling to cut Canadian taxes and businesses grappling with minimum wage hikes, a weak dollar will be necessary to keep the economy on track, said Rosenberg.

“We are going to have to continue to rely on the cheap Canadian dollar as an artificial source of competitive stimulus that we are not getting on the tax side.”