Apr 26, 2024

Nomura Rebounds as Fixed Income Trading Soars, Expenses Rise

, Bloomberg News

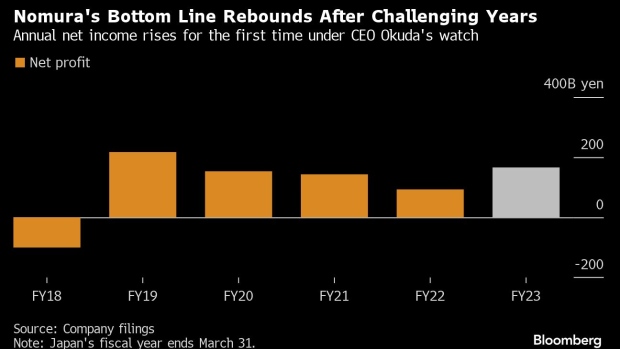

(Bloomberg) -- Nomura Holdings Inc.’s earnings climbed as soaring fixed-income trading and resurgent markets in Japan helped Chief Executive Officer Kentaro Okuda achieve the first increase in annual profit under his watch.

Net income rose to 56.8 billion yen ($364 million) in the quarter ended March 31 from a year earlier, the company said in a statement Friday. That helped Nomura end three straight years of declining profit.

Still, annual compensation expenses also rose with inflation, the weaker yen and performance bonuses, Japan’s biggest brokerage said. The firm also warned of a provision arising from “settlement failures with a broker counterparty,” that totaled around $90 million. All that meant profit came in just under the the 72.3 billion yen average estimate of three analysts.

The result is a boost for Okuda, who took the helm in 2020, as his turnaround gets a tailwind from Japan’s economic revival across investment banking and the retail brokerage. The upending of the nation’s government bond markets has sparked fresh interest from hedge funds, while investors have increasingly turned to Japanese stocks amid a slowdown in China.

Nomura got a lift from the expansion of a program that allows tax-free investing for individual investors in Japan, which boosted stock trading and sales of investment trusts in the quarter.

That may underpin efforts to accelerate an overhaul of Nomura in recent quarters, from cost cuts overseas to strengthening wealth management services at home. Nomura will continue to keep a lid on costs at the wholesale division, which houses trading and investment banking, Chief Financial Officer Takumi Kitamura said at a press briefing in Tokyo.

“The wholesale result is good. Business including fixed income trading was relatively solid,” said Hideyasu Ban, a Bloomberg Intelligence analyst. “Overall, however, they need to make yet more efforts” as Nomura’s return on equity still undershoots its longer-term goal of 8% to 10%, he said. The firm’s ROE currently stands at 5.1%.

Trading Gains

Fixed-income trading revenue rose 40%, topping US and European banks who have reported so far, as many struggled apart from Goldman Sachs Group Inc. The outlook for the business has improved for Nomura after Japan’s central bank dialed back stimulus, liberating the debt market from its tight control and boosting the outlook for bond transactions. Fixed income trading generates roughly a quarter of the company’s revenue.

Nomura’s key wholesale division, led by Christopher Willcox, returned to profit after a pre-tax loss a year earlier, as he moves to accelerate cost cuts and lift revenue.

The profitability of the wholesale business improved significantly in the second half, Kitamura said, adding that “momentum” for the business is intact.

The revival plan involves expanding credit markets and foreign exchange business in the US using its Asian operations as a model. Nomura has also made a push into the European equities business. Alongside that, Willcox has also implemented a broader review of the business model to reduce costs.

Smaller local rival Daiwa Securities Group Inc. posted quarterly profit that more than doubled on the back of retail and institutional investors flocking to trading. Elsewhere, Deutsche Bank AG, which reported Thursday, unveiled better-than-expected fixed income trading as its investment bankers made up for a slowdown in lending. London-based rival Barclays Plc posted first-quarter profits that topped analyst estimates after its stock traders collected a surprise windfall from tumultuous global markets.

(Adds charts, comment from Bloomberg Intelligence analyst.)

©2024 Bloomberg L.P.