Apr 26, 2024

Novaland Plans Share Sale, New Loans to Ease Cash Crunch

, Bloomberg News

(Bloomberg) -- Novaland Investment Group, among Vietnam’s largest real estate developers, is planning to sell shares and increase borrowings after securing bondholders’ approval to restructure $300 million of notes to address a liquidity crunch.

The Ho Chi Minh City-based builder aims to raise almost 28 trillion dong ($1.11 billion) this year from loans and equity sales to boost available cash, Chief Executive Officer Ng Teck Yow said in an interview before the annual shareholders’ meeting.

“We managed to get the time we need to extend the debt terms with the help of the recent changes in the law,” Ng said. The new rule allows borrowers facing a cash crunch to extend repayments and use other assets to pay down bonds, subject to approvals from debt holders.

Vietnam’s developers have faced a cash shortage amid a government crackdown on capital markets that’s led to the arrest of some executives. A court recently sentenced real estate tycoon Truong My Lan to death for her role in a $12 billion fraud case.

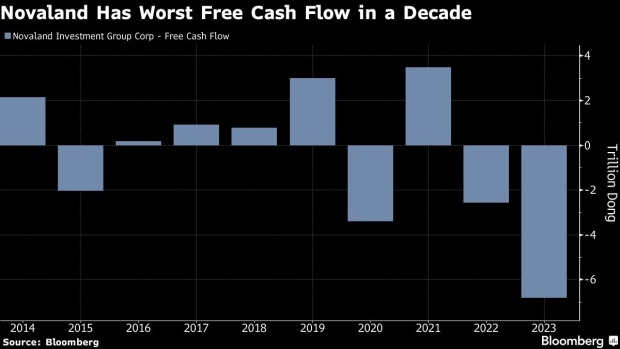

Novaland has been burning cash in recent years and recorded negative free cash flow of nearly 7 trillion dong in 2023, the most in at least a decade, according to data compiled by Bloomberg.

The developer has approval to extend the maturity of the $300 million of bonds to 2027, Ng said. It missed an interest repayment on the notes last July, when the government’s anti-corruption campaign impeded corporate debt issuance. Along with borrowing 16 trillion dong from banks, it aims to raise nearly 12 trillion dong from share sales.

Of its total fund raising target, Novaland aims to use 11.7 trillion dong from selling shares to pay down debt and meet other cash demands and 16 trillion dong from financial institutions for project developments.

Novaland had short-term liabilities of about 87.3 trillion dong, including 31 trillion dong in borrowings, as of the end of 2023, according to the company’s financial statement. It has been raising cash by selling assets and converting debt to equity in some projects, Ng said.

New corporate bond issuance in the Southeast Asian nation this year through March 22 shrunk by 36% from a year earlier, the finance ministry said in an April 9 report.

Novaland expects to increase handovers of homes by more than 10 fold this year and boost revenue to 32.6 trillion dong for an annual profit of 1.1 trillion dong, Ng said.

Read: What’s Behind Vietnam’s Non-Stop Corruption Crackdown: QuickTake

(Updates with details on the usage of the cash in paragraph 7)

©2024 Bloomberg L.P.