Mike Cagney’s Figure Technology Taps Tannenbaum as Its New CEO

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

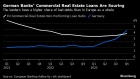

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Mar 10, 2017

, The Canadian Press

TORONTO -- The Toronto Real Estate Board is urging the Ontario government not to implement a tax on foreign buyers, arguing that it would do little to address the problem of rising house prices in Canada's largest city.

Finance Minister Charles Sousa said Thursday that he's considering implementing such a tax as a possible option to cool Toronto's red-hot housing market.

Finance Minister Charles Sousa left the door open to the possibility of taxing foreign buyers last year when he spoke with BNN, saying the provincial government was “assessing the impacts” of British Columbia’s 15 per cent levy on foreign buyers.

But house prices have continued to soar, with February data from TREB showing that the price of a detached, single-family home rose 29.8 per cent from a year ago.

TREB says that a foreign buyer tax would not address the supply shortage that has been driving home prices higher.

The real estate board also argues that concerns about the impact of foreign buyers on the real estate market in the Greater Toronto Area are "widely overblown."

"The fact that most foreign buyers are looking to purchase a home for their family, for personal use, or to provide a tight rental market with much needed supply is something to be encouraged, as these actions are essential to Ontario's economic success," TREB president Larry Cerqua said Friday in a statement.

"Imposing a tax on foreign buyers will not have the desired effect of cooling the housing market and could create adverse effects on the national, provincial and GTA economies."

Eric Lascelles, chief economist at RBC Global Asset Management, told BNN in an interview Friday he thinks Toronto is in a bubble but said that doesn’t mean that prices will explode and suddenly drop.

“I think it would be good if the Toronto market cooled," he said. "I think there’s quite a number of ways that could happen. A foreign tax would do it. You could also tax blonde-haired people and that would do it too. I would imagine from a political perspective it’s probably easier to tax foreigners than to tax people who are perhaps voting for them.”

The Ontario Real Estate Association has come out against a foreign buyers' tax, saying the overwhelming majority of foreign home buyers are immigrants or permanent residents looking for a home, not speculators.

"The main culprit behind rapidly rising house prices is the GTA's unbalanced market — housing supply cannot meet demand — not foreign buyers," CEO Tim Hudak said Thursday in a statement. "Home affordability needs to be addressed before millennials are completely priced out of the market."

"Before we pin a tax on foreigners, we need to address the elephant in the room and that's the lack of housing supply," Hudak said.

- with files from BNN