Mar 14, 2018

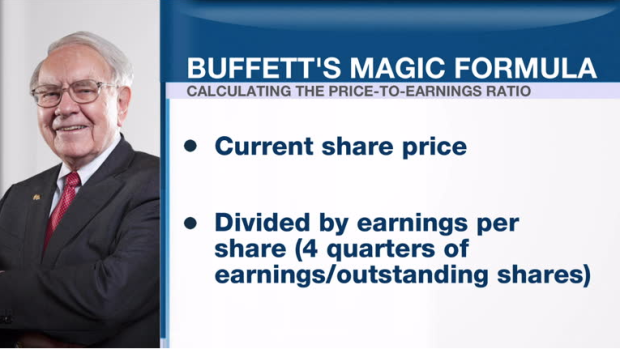

Personal Investor: Be like Buffett by mastering the P/E ratio

By Dale Jackson

It’s no coincidence Warren Buffett is one of the richest people in the world. His secret for success is no secret at all. Everything comes down to earnings.

In all the hoopla from market pundits we tend to forget that the price of any stock is a reflection of what the market believes is the company’s earnings potential. Even revenue growth is pointless if costs can’t be minimized.

Sometimes the market overestimates a company’s earnings potential thus driving the stock price above its true value. That’s a sell signal. Sometimes it is underestimated, and that’s when Buffett and company look for bargains by employing the price-to-earnings, or P/E ratio.

It’s a simple formula: the current share price divided by earnings per share (EPS) over a period of four quarters. EPS is determined by dividing total earnings by the total number of outstanding shares. A trailing P/E factors in earnings from the past four quarters and a forward P/E uses estimates for the future four quarters.

For example, if a company is currently trading at $50 and earnings over the last 12 months were $2 per share, the trailing P/E ratio would be 25.

In general, a high P/E suggests that investors are expecting higher earnings growth in the future compared to companies with a lower P/E. However, the P/E ratio doesn't tell us the whole story by itself. It's usually more useful to compare the P/E ratios of one company to other companies in the same industry, to the market in general or against the company's own historical P/E.