Mar 7, 2018

Personal Investor: Make CPP and OAS part of your retirement plan, not all of it

By Dale Jackson

What is it about the Canada Pension Plan that makes Canadians so goofy?

A recent survey by the CPP Investment Board found 64 per cent of us aren’t counting on it for retirement, despite a report from the chief actuary that certifies the plan is sustainable for at least 75 years in its current form.

At the same time, the survey revealed 42 per cent of Canadians “rely to a great extent” on CPP when they retire, even though the maximum annual payout at age 65 is currently $13,370.

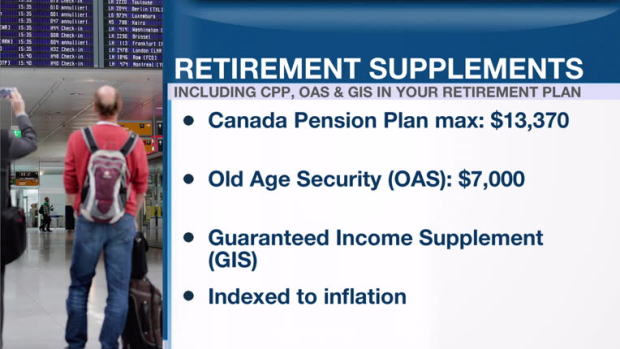

The truth is somewhere in the middle; the Canada Pension Plan, along with Old Age Security (OAS), is intended to be a retirement supplement. It’s up to individual Canadians to determine how much they need in retirement and ensure they save enough on their own.

Here are some basic features of our government-sponsored retirement supplements:

The current maximum CPP benefit of $13,370 a year at age 65 is based on how much you contribute during your working life, and for how long. If you would like to know where you stand, your Canada Revenue Agency online profile provides a link. You can opt to receive CPP payments as early as age 60, but the amount will be lower. If you wait until you’re 70 years old, it will be higher. Quebec has a separate pension plan (QPP), but the basics are the same.

Most Canadians 65 and older are also entitled to OAS, regardless of whether they’ve been working or not. The maximum payment is currently about $7,000. But if your income exceeded $74,788 for the 2017 tax year, you have to repay part or all of your OAS pension benefit in the form of a "clawback."

And there’s the Guaranteed Income Supplement (GIS), which boosts OAS payments for low-income seniors.

One of the best features of all three supplements is that they are adjusted to inflation. That means the payout will increase with the cost of living.