Dec 18, 2017

Personal Investor: Retirees can still save tax dollars by income splitting

By Dale Jackson

The political hot air over Ottawa’s crackdown on “income sprinkling” is casting a fog over the broader issue of income splitting. Much of the current controversy focuses on income that is generated by working Canadians, but pensioners 65 years or older can still split up to 50 per cent of their pension income. In some cases, you can split pension income before 65.

Income splitting can save thousands of tax dollars when a spouse in a higher tax bracket shares part of their income with a spouse in a lower tax bracket. At best, it can lower a tax rate from 50 per cent to 20 per cent. That’s a tax saving of $30,000 on $100,000, as an example.

Income splitting can also reduce or eliminate the clawback on Old Age Security payments or the age credit for the higher-income spouse.

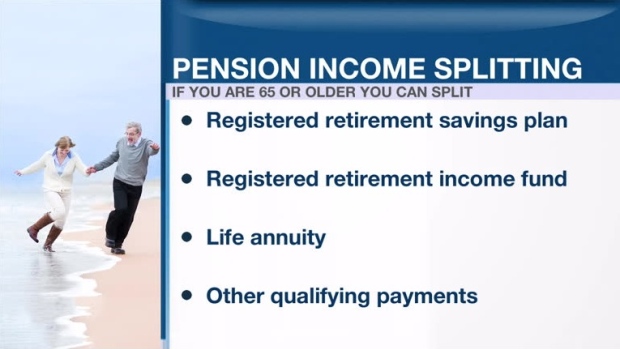

If you are 65 or older, you can split income from your registered retirement savings plan (RRSP), registered retirement income fund (RRIF), life annuity, and other qualifying payments.

If you are under 65, only certain life annuity payments and amounts received from the death of a spouse, such as an RRSP and RRIF, are eligible for pension splitting.

Spousal RRSPs are another way of splitting pension income before 65 but it requires years of advance planning. A higher income spouse who contributes to a spousal RRSP can deduct the contribution from their taxable income and the lower income spouse can withdraw funds in their tax bracket provided at least three years have passed since the last contribution.

Pension income splitting can also allow both partners to claim the $2,000 pension income tax credit.

Tax software can help determine the right amount of income to be split to get the biggest advantage.