Dec 20, 2017

Personal Investor: Seg funds to reveal fees in dollars

By Dale Jackson

The Canadian Council of Insurance Regulators (CCIR) is pushing for full-dollar disclosure for segregated funds.

The move comes on the heels of recently-implemented disclosure rules, called CRM2, that require mutual fund advisor fees to be expressed in dollar amounts in addition to percentages. Percentages are often much easier for consumers to swallow than a flat-out dollar amount, and that's why the industry has been dragging CRM2 out for over a decade.

Until now segregated funds have been exempt from CRM2 rules because they are considered insurance products. Seg funds are like mutual funds wrapped in an insurance product because 75-to-100 per cent of the principal is guaranteed.

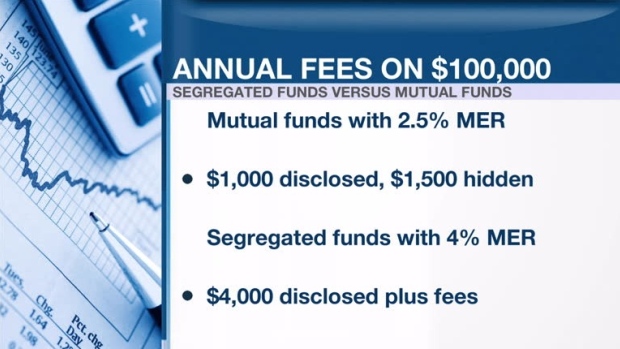

You pay a price for that security. Annual fees for segregated funds, also known as the management expense ratios (MER) can reach four per cent compared with a 2.5 per cent MER for a typical mutual fund. Most seg funds also have one-time fees known as loads when they are bought and sold.

But, in a surprise twist, seg fund dollar disclosure goes far beyond mutual funds. CRM2 only requires the advisor portion of the MER be expressed in dollars, which is typically one per cent embedded in that 2.5 per cent MER. Every $100,000 invested in a mutual fund, for example, would generate an annual fee of $2,500 but the statement would only reveal the $1,000 trailer fee in dollars.

By 2019 investors in segregated funds will have the entire amount revealed on their statement, and what they see could come as a shock. Every $100,000 invested in seg funds would result in an annual bill of $4,000 plus any other one-time fees and commissions.

Mutual fund industry representatives say they are moving toward full-dollar disclosure. How investors will react is unkown, but at least all the cards will be on the table.