Apr 16, 2024

Philippine Central Bank Chief Says Peso Fall Won’t Affect Policy

, Bloomberg News

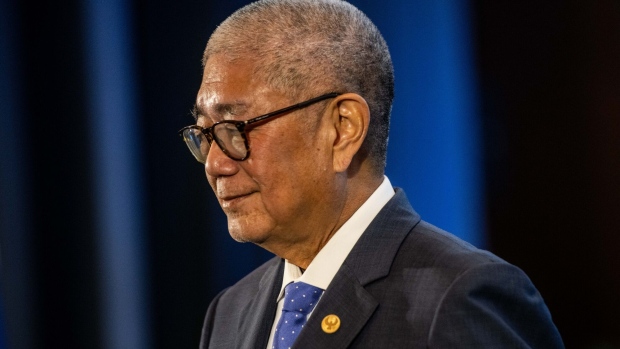

(Bloomberg) -- The Philippine peso’s slide to a 17-month low isn’t large enough to derail monetary easing later this year or early next year, according to central bank Governor Eli Remolona.

“I would say the central scenario would be we ease in 4Q. If things are worse, then we might postpone to first quarter 2025,” the Bangko Sentral ng Pilipinas governor said in his monthly briefing on Wednesday. The peso’s movement “so far is not going to change what we think we might be doing” at the next policy meeting on May 16, he said.

Emerging-market currencies including the peso have been under pressure in recent days as the odds of an early rate cut globally wane. The peso fell past the closely watched 57-per-dollar level for the first time since November 2022, as expectations that the Federal Reserve will delay interest-rate cuts weighed on risk assets.

The Philippine policymaker, who was interviewed by Bloomberg News on Monday, maintained a broadly hawkish stance and stuck to a guidance that further rate hikes are unlikely and the peso’s weakness is mostly due to dollar strength.

“I wouldn’t say it’s performing poorly. I would say it’s adjusting to some events,” the BSP chief said on the peso. “Unless the movements are very sharp, we tend to allow the adjustment to happen,” he said.

Market participants who anticipated an early rate cut may be overreacting to the Fed’s signal that rates would stay where they are for as long as necessary, he said. “I myself never thought the FOMC will adjust sooner than what we have said,” Remolona said, adding that Fed easing could happen late in the third quarter.

The benchmark rate — currently at a 17-year high of 6.5% — is “already tight,” Remolona said. The currency fell a fifth day on Wednesday to as low as 57.29 against the dollar. The governor had described 57 as a “weak support level,” meaning it’s not a key focus. Still, that level is closely watched as he signaled seven months ago that the BSP was intervening at 57.

The central bank has hardly intervened in the currency market in recent weeks, Remolona said Monday, and that he’s comfortable with the peso’s current levels which was then trading at near six-month lows. He didn’t give a comment on intervention on Wednesday.

“The most scary thing is when there’s deanchoring. When the markets, the households begin to believe that inflation will surge, then we have to consider a rate hike,” he said. At this point, the BSP isn’t seeing that, according to the governor.

(Updates with details throughout.)

©2024 Bloomberg L.P.