Apr 16, 2024

Rupee Drops to Record Low as Dollar Strength Weighs on Sentiment

, Bloomberg News

(Bloomberg) -- Sign up for the India Edition newsletter by Menaka Doshi – an insider's guide to the emerging economic powerhouse, and the billionaires and businesses behind its rise, delivered weekly.

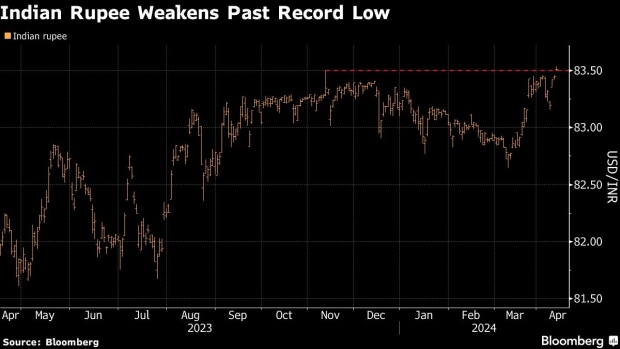

The Indian rupee fell to a record low as a stronger dollar weighed on regional sentiment.

The currency dropped as much as 0.1% to 83.5350 per dollar on Tuesday, breaching its previous intraday low of 83.50 hit in November, according to prices compiled by Bloomberg. Stocks also fell, with the S&P BSE Sensex Index trading down 0.5%.

A drop in yuan spurred by China unexpectedly weakening its currency defense and simmering tensions in the Middle East that risk fanning costlier oil contributed to the risk-off mood. Crude oil is India’s biggest import and higher prices may hurt the economy at a crucial time before national elections.

Read More: Dollar Bulldozes Its Way Through Asian FX With Help From Yuan

A weaker rupee prompted traders to speculate the central bank may use its record foreign exchange reserves and intervene in the market to curb volatility. Still, the rupee was among the best-performing emerging market currencies on Tuesday, declining much less than Indonesia’s rupiah and the South Korean won.

“Considering India’s FX reserves at an all-time high, the RBI may use this ammunition to curtail any kind of excessive volatility,” said Kunal Sodhani, vice president at Shinhan Bank. The weakening of the Chinese yuan, the dollar index moving higher and outflows from domestic equities are putting pressure on the Indian rupee, he said.

--With assistance from Subhadip Sircar.

©2024 Bloomberg L.P.