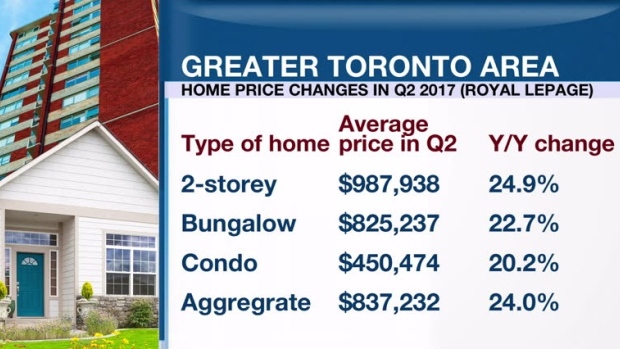

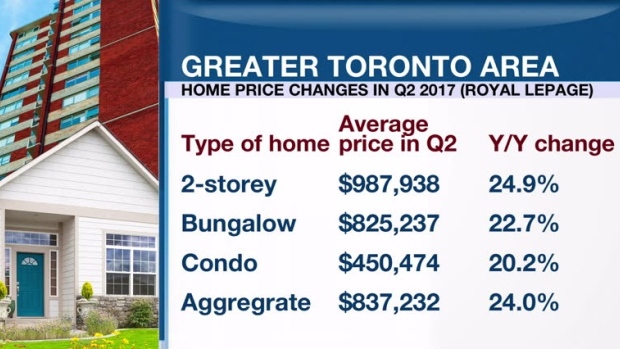

A new report from Royal LePage says “sanity” began to return to the Greater Toronto housing market in the second quarter of 2017, as the rate of home price growth slowed following the implementation of government measures to cool the housing market.

Ontario’s slate of measures pushed some would-be buyers to the sidelines and homeowners to cash in, triggering an abrupt drop in sales and a spike in new listings. And that helped to put some of the power back in the hands of home purchasers.

“For the first time in years, buyers are able to include reasonable conditions in their offers and multiple bid situations are somewhat less frequent,” said Phil Soper, CEO of Royal LePage.

The reprieve could prove to be temporary, as seen in Vancouver’s housing market, which is slowly recovering after a foreign buyers tax was imposed by the provincial government.

“In Vancouver and Toronto, we have buoyant economies that are attracting thousands of new residents each year. These people will need a place to live and no amount of initiatives aimed at quelling demand will change that,” said Soper.

While Ontario’s Fair Housing Plan still has not fully addressed affordability issues in Greater Toronto, it has caused home price appreciation to slow on a monthly basis.

As real estate markets in Toronto and Vancouver start to slow and markets in Calgary and Edmonton begin to stabilize, Royal LePage says the wide divergence seen in various parts of the country is finally starting to close.

“Following a period of unprecedented regional disparity in activity and price appreciation, we are now seeing a return to healthy growth in the majority of Canadian housing markets,” said Soper.

“The white-hot markets are moderating to very warm; the depressed markets are beginning to grow again. Canadian housing is in great shape – a statement that I certainly did not make last quarter.”