Jul 12, 2017

Rate watching: Canada's top economists make their Bank of Canada predictions

With the Bank of Canada’s interest rate decision coming today, BNN asked some of the country’s top economists what they think the central bank will do and why.

Here’s what they had to say:

Beata Caranci, Chief Economist, TD Economics, TD Bank Group

“The bank can certainly afford to wait until October to confirm that a floor has formed under inflation. But, the abrupt change in bank rhetoric in recent weeks has not conveyed a patient tone to markets. This may be a true indication of a growing discomfort on the balance of risks, particularly for household debt levels.” (MORE)

Frances Donald, Senior Economist, Manulife Asset Management

“The Bank of Canada will likely hike rates on July 12, but what matters more is how they will describe the evolution of their thinking. The better we can understand what prompted the apparent shift in the BoC’s decision-making function over the past month, the more likely we are to understand where rates are headed next.” (MORE)

Derek Holt, Vice President & Head of Capital Markets Economics at Scotiabank

“Canada is well past having to cling to emergency levels of monetary stimulus that date back to the 2009 recession and accompanied by very easy financial conditions. While there are risks to the outlook, many of them are overstated and monetary policy cannot be held hostage by a permanent array of ‘what-ifs’.” (MORE)

David Madani Senior Canada Economist, Capital Economics

“Raising interest rates now at this very late stage in the housing cycle would be misguided. If we are wrong and the Bank begins to increase interest rates this week, it would likely prove to be the shortest rate hike cycle in Canadian history and rival the ECB’s short-lived policy error in 2011.” (MORE)

Doug Porter, Senior Economist, BMO

“The one major quibble on the move would be the fact that oil prices continue to struggle to stay much above US$45 per barrel, keeping a lid on inflation and presenting an ongoing risk to the nascent recovery in Alberta.” (MORE)

Avery Shenfeld, Managing Director and Chief Economist at CIBC Capital Markets

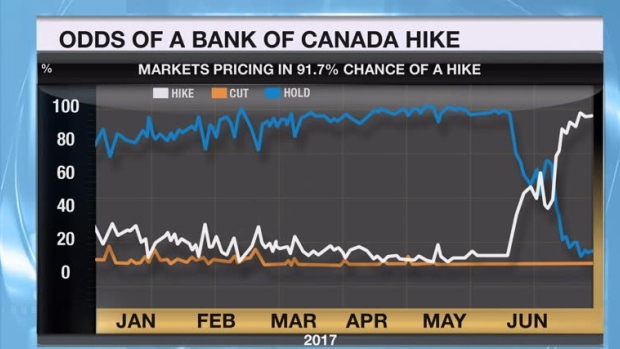

“We’ll trade off a bit of a delay in getting to sustained two per cent inflation if that helps cool Canadians’ debt appetite. Solid economic data make it likely that the BoC will indeed go ahead with a hike this week. That still isn’t a sure thing, even though the financial market sees it that way.” (MORE)