Jun 28, 2017

Empire shares spike as turnaround starts to 'take root'

Investors are getting their first true progress report on Michael Medline's turnaround plan at Sobeys.

The grocer's parent, Empire Company (EMPa.TO), saw its adjusted profit nearly halved to $50.2 million in the fiscal fourth quarter, from $95.3 million a year earlier. Sales fell to $5.8 billion from $6.3 billion. The year-ago period included an additional week of sales. On an adjusted per share basis, Empire earned 18 cents.

Analysts, on average, expected Empire to earn 12 cents per share on $5.76 billion in sales.

"The initial efforts we have put in motion are starting to take root," Medline said in a statement. "We are seeing positive signs with increased tonnage for the first time in 17 quarters, stabilizing margins and disciplined cost containment."

Medline was named CEO of Empire in January, inheriting the task of cleaning up a company that was still struggling to integrate the $5.8 billion takeover of Safeway Canada. The results announced on Wednesday cover the first full three-month period since he took over. Investors have shown early faith in his plan, with Empire's stock surging 23 per cent since the day he was appointed through the close of trading Tuesday.

HAVE YOUR SAY

Where do you prefer to buy your groceries?

Empire rewarded shareholders for their confidence on Wednesday, boosting the annual dividend to 42 cents per share from 41 cents.

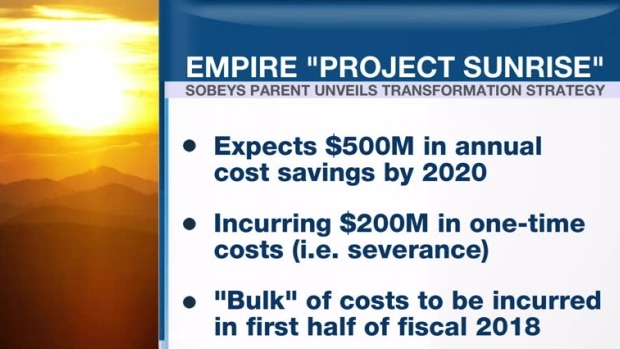

Medline mapped out his plan in early May with the release of a project dubbed Project Sunrise, a cost-cutting mission aimed at saving $500 million annually by 2020. On Wednesday, the new CEO acknowledged he's only in the early stages.

"We are not where we want to be and we are most certainly not out of the woods yet," he said. "Although we are doing a better job of managing our day-to-day business, we remain in the nascent stages of delivering significant cost savings while addressing a number of brand and customer offering opportunities."

The elephant in the room for the entire grocery sector is Jeff Bezos’ plan to expand his empire with Amazon’s (AMZN.O) US$13.7-billion takeover of Whole Foods (WFM.O). While the high-end niche retailer has a limited footprint of just 13 stores in this country, that hasn’t stopped investors from fearing the impact on incumbents.

“You’re going through a period of massive price deflation in the food space, you’ve got acquisition hangovers, you’ve got a turnaround plan to deal with [at Sobeys], and now you have to accelerate your automation and you’re e-commerce platform,” BlackRock Canada Chief Investment Strategist Kurt Reiman said in an interview with BNN.

“That’s a lot to digest.”