Mar 14, 2018

‘Something’s wrong here’: U.S. at risk of ratings downgrade, portfolio manager warns

, BNN Bloomberg

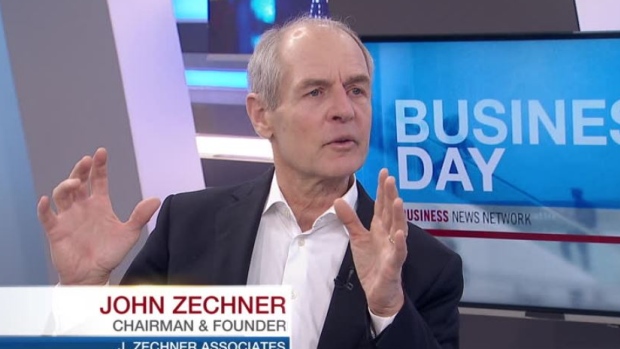

Recent weakness in the greenback may be a sign of greater ills in the U.S. economy, which is likely to prompt a ratings downgrade from one of the credit agencies, portfolio manager John Zechner said in an interview with BNN Wednesday.

“Despite all of these increases in interest rates and not bad economic growth, the U.S. dollar has actually been in a bit of a bear market after peaking early last year. And why is that? ... The [U.S. dollar] is telling you something’s wrong here,” the founder and chairman of J. Zechner Associates said.

“It wouldn’t surprise me if one of the credit rating agencies turned around and downgrades U.S. debt, which is going to raise their costs.”

An index measuring the U.S. dollar relative to a basket foreign currencies shows the greenback has declined more than 13 per cent from its Dec. 28, 2016 high,

Zechner added that the greenback has been under pressure because of mounting U.S. national debt, which now exceeds US$20 trillion.

The high turnover among U.S. President Donald Trump’s senior staff has also led to concerns for investors, Zechner said.

“It’s scary, you can see the strategic logic of what’s going on. Donald Trump is starting to run his own show and he’s said all along, ‘I’m the only one that matters,’” Zechner said.

“He’s getting rid of everyone else who’s been giving the market a little bit of calm, like [National Economic Council Director Gary] Cohn and [U.S. Secretary of State] Rex Tillerson, who were business people.”