Aug 3, 2017

Tesla Model 3 demand, higher revenue propel electric car maker's shares higher

, Reuters

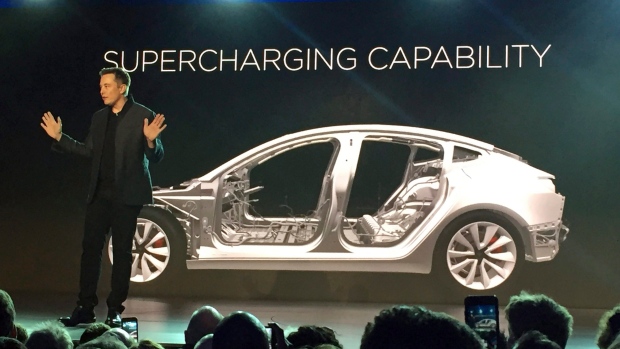

Tesla Inc's (TSLA.O) shares jumped 7.2 per cent on Thursday, highlighting investors' faith in CEO Elon Musk's ability to turn around the loss-making company even as it guzzles cash to ramp up production of its mass-market Model 3 sedans.

Gains in the high-flying stock, which has already risen 52 per cent this year, were set to add nearly US$4 billion to Tesla's market value.

Tesla said on Wednesday quarterly revenue doubled and that it was receiving more than 1,800 daily reservations for the newly launched Model 3s.

Tesla has burned through over US$2 billion in cash so far this year ahead of the launch, and expects to spend another US$2 billion in the second half.

The company's aggressive spending has been a lightening rod for criticism, but investors have continued to bet on CEO Elon Musk's clean-energy vision and the success of the Model 3.

"Early Model 3 launch milestones look strong, but the US$2bn of 2H capex will make your eyes water," said Morgan Stanley analyst Adam Jonas.

"Time will tell if they are tears of joy."

Tesla is counting on the Model 3, launched late last month, to help it turn profitable and transform it from a niche player to a heavyweight in the automobile industry.

"We believe a positive reception to the Model 3 from early customers could significantly increase the value of the Tesla brand and further accelerate demand," Baird Equity Research analyst Ben Kallo said.

At least two brokerages raised their price targets on the stock. RBC Capital Markets raised its target price by US$31 to US$345, pushing it well ahead of the median price target of US$322.

However, growing pains, mostly in the form of production delays and funding issues, are challenges that Tesla needs to overcome.

Tesla's last launch was the luxury Model X SUV in 2015, which had several production problems and a price tag starting around US$80,000.

Musk has tried to reassure investors saying that a simpler Model 3 design will greatly reduce potential assembly-line problems.

"While we don't have meaningful reason to doubt that Tesla can eventually achieve its targets, doing so in a timely manner without some growing pains could prove challenging," RBC Capital Markets analyst Joseph Spak said.

The Model 3 is part of Musk's broader plan to build a clean energy and transportation company that offers electric semi trucks, rooftop solar energy systems and large-scale battery storage systems.

Tesla also said demand for its Model S and X cars remained strong, allaying concerns that the launch of the cheaper Model 3 would eat into sales of its more expensive vehicles.

The company's shares were up 5.9 per cent at US$345.27, having given up some of their earlier gains.