Apr 4, 2018

The facts of life (insurance)

Presented by:

Life insurance may be one of the most important purchases you make. If you think a policy is too expensive, or your employer-offered insurance is enough, think again.

When Jill’s husband died just a few months ago, filing life insurance claims was not on her list of priorities. His death from cancer wasn’t a surprise, but living the rest of her life without him was overwhelming. Her son took the reins and filled out the paperwork to claim the tidy sum that would help to cover funeral expenses, and a little extra for the family. “We never really talked about life insurance,” says Jill. “We kept our finances completely separate, but I know he had a term policy. Our home is paid for, and I’m self-employed and still working, so we never thought life insurance was a necessity.”

Even though Jill’s payout was a modest sum, at least she and her husband had purchased policies, which put them ahead of many Canadians. According to a poll by TD Insurance and Environics Research Group, which surveyed 1,500 Canadian adults, 3 in 10, or almost one-third of Canadians don’t have any life insurance.1 That means that they may be leaving their loved ones in a financial lurch once they’re gone.

One reason that many don’t have life insurance is because death is hard to talk about and come to terms with. “No one wants to think about their death and its consequences for loved ones,” says Anna Kavanagh, Vice President at TD Insurance. “Canadians believe that life insurance is important but they put off the buying decision and so it’s not usually top of people’s priorities. It should be.”

When people avoid discussing difficult topics, that’s when myths propagate. Here are five of the top myths about life insurance, and the facts:

1) MYTH: My employer’s life insurance program is adequate

FACT: Generally, employers provide employees with life insurance that could be equal to one or two times their annual salary; sometimes you have an option to purchase up to six or seven times your salary. But, in today’s work environment, commissions, bonuses and second jobs often mean that your actual salary is a small part of your big income picture. “Employer’s life insurance or group insurance is a good start, but it probably shouldn’t paint the whole picture,” relays Kavanagh. “There may be limitations on how much and what type of coverage you can keep if you leave your job.”

You might need additional individual insurance. Individual insurance is a contract between the client and the insurance company and not tied to an employer. It is portable if your employment changes and includes contractually guaranteed coverage, definitions and premiums. Experts suggest that you probably need somewhere between five to twelve times your salary to replace your income for dependents. And even if you can convert your employer policy to an individual policy down the road, it might be more expensive than purchasing that individual policy today, particularly if you are young and healthy. With those factors at play, you can view employer-offered insurance as a bonus.

2) MYTH: I’m not the main breadwinner, so I don’t need life insurance

FACT: People assume that if the person who brings home the proverbial bacon has insurance, then the household can function financially when that person is gone. But a loss of the lower-income or stay-at-home parent might mean hired help needs to be brought in to replace that person’s contribution to the household. “Ensuring a breadwinner’s income is replaced through the use of life insurance is important but many members of the family make a contribution to the family enterprise,” says Kavanagh.

“Even a stay-at-home spouse provides important services that would need to be replaced at his or her death, like child-care, in order for the income earning spouse to remain in the workplace.” Having an insurance policy on the lower income spouse will also give the main breadwinner a chance to take time with children, and help the family deal with their loss, should they lose that loved one.

3) MYTH: Life insurance is too expensive

FACT: According to industry research by LIMRA (Life Insurance and Market Research Association, now LIMRA International), almost 80% of consumers overestimate the cost of life insurance.2 Jill agrees that the perceived expense might be the reason that she and her husband didn’t purchase more. But, life insurance can actually be very affordable. For example, if you are a healthy 35-year-old woman who doesn’t smoke, you could have $250,000 in life insurance coverage for 10 years for about $13 per month. “The most expensive form of life insurance can be not having any insurance at all,” suggests Kavanagh.

“A 30-year-old making $100,000 per year can expect to earn an indexed $6.3 million to age 65. The cost for a policy that would protect the family for the next 20 years would be a tiny fraction of the income that would be lost without insurance.”

Because life insurance companies base premiums on a variety of factors (your age, overall health, whether you smoke, family history, etc.), it’s hard to predict what kind of premiums you will pay, but the younger and healthier you are, the less expensive it will be. It doesn’t hurt to ask.

4) MYTH: I’m too young to worry about life insurance

FACT: Life insurance actually makes the most sense when you’re young since premiums will be much less expensive and you will have fewer assets to take care of your family when you’re gone. When you are older, and potentially have medical conditions, it may be difficult to buy insurance and if you can, it will likely be expensive. “Generally speaking you should start thinking about insurance when there is an obligation to provide for someone else after your death,” discloses Kavanagh. “For example, an obligation to provide for a spouse, a young family, to care for elderly parents or an obligation to fund a mortgage on the home so that the debt doesn’t outlive the person. In that sense, the young adult years are usually when we start to think about life insurance.”

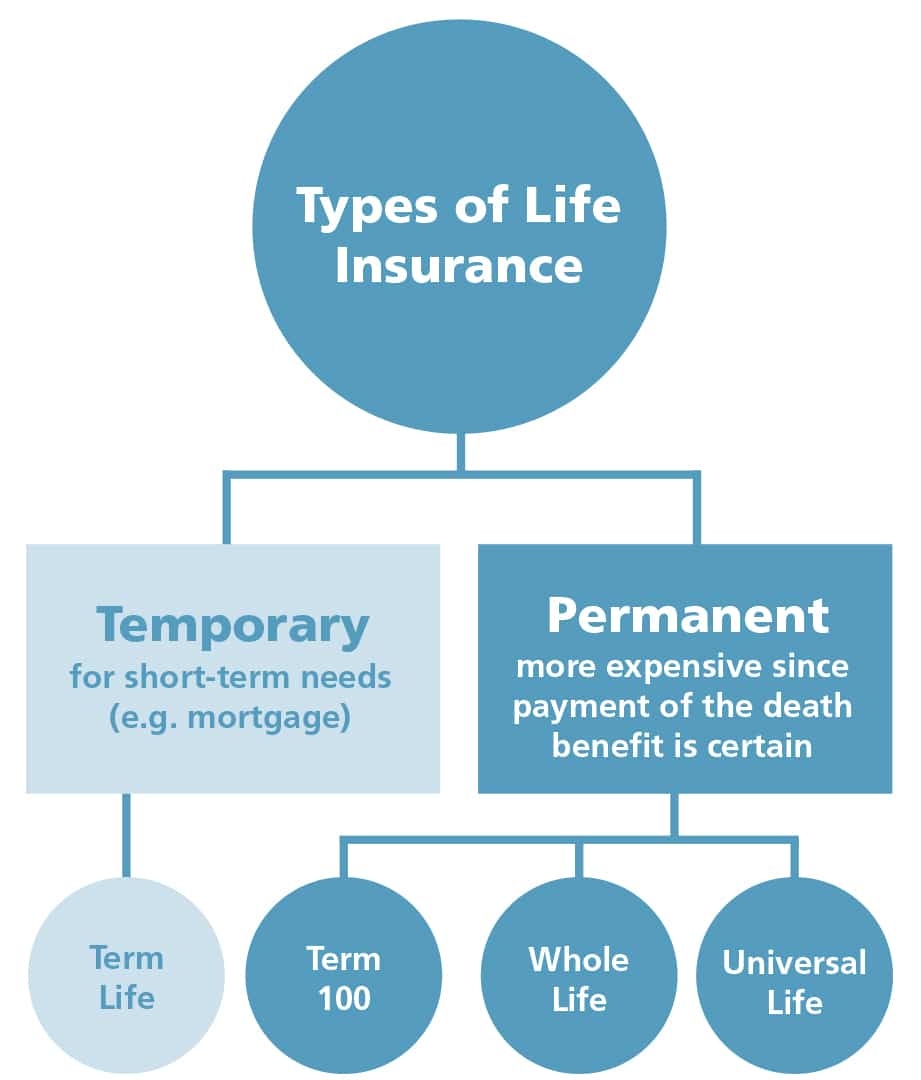

5) MYTH: Term life insurance is all I need

FACT: Term policies usually provide coverage to age 75 or 80, but premiums increase after a certain period of time — most commonly ten years — so when the policy renews and you’re ten years older, it is more expensive than the first time around. A permanent policy is designed to pay off whenever death occurs, and you always pay the same premium despite your age and medical history. The ideal situation might be a mix of temporary and permanent insurance.

There are many options for life insurance. To find out if life insurance is right for you, and how to address your unique needs, talk to your advisor. “Life insurance allows us to keep together what we’ve put together,” says Kavanagh. “For a young family, the loss of a spouse or parent can have a devastating financial impact on the remaining members. Life insurance can replace the income lost due to the death of a breadwinner and allow the family to maintain the standard of living they are accustomed to.”