Buying a home in Canada can be a costly proposition, especially in some cities where those with modest incomes are almost completely priced out of the market. That can be especially true if said buyer isn’t able to combine their salary with a spouse or partner, giving them more purchasing power, or have a parent willing to help with the down payment.

A recent report from Zoocasa shows that even the least expensive cities in the country can require a major financial commitment for solo buyers. Experts say individuals shouldn’t be spending more than three times their annual income on a home. But according to Zoocasa’s report, the average buyer would have little choice but to break that rule.

“Overall, even in the least housing expensive markets, home ownership is a significant expense for single people in Canada,” Zoocasa CEO Lauren Haw said. “Our report found that a single homebuyer would need to spend a minimum of four times their annual income to be able to afford a home on in their own.”

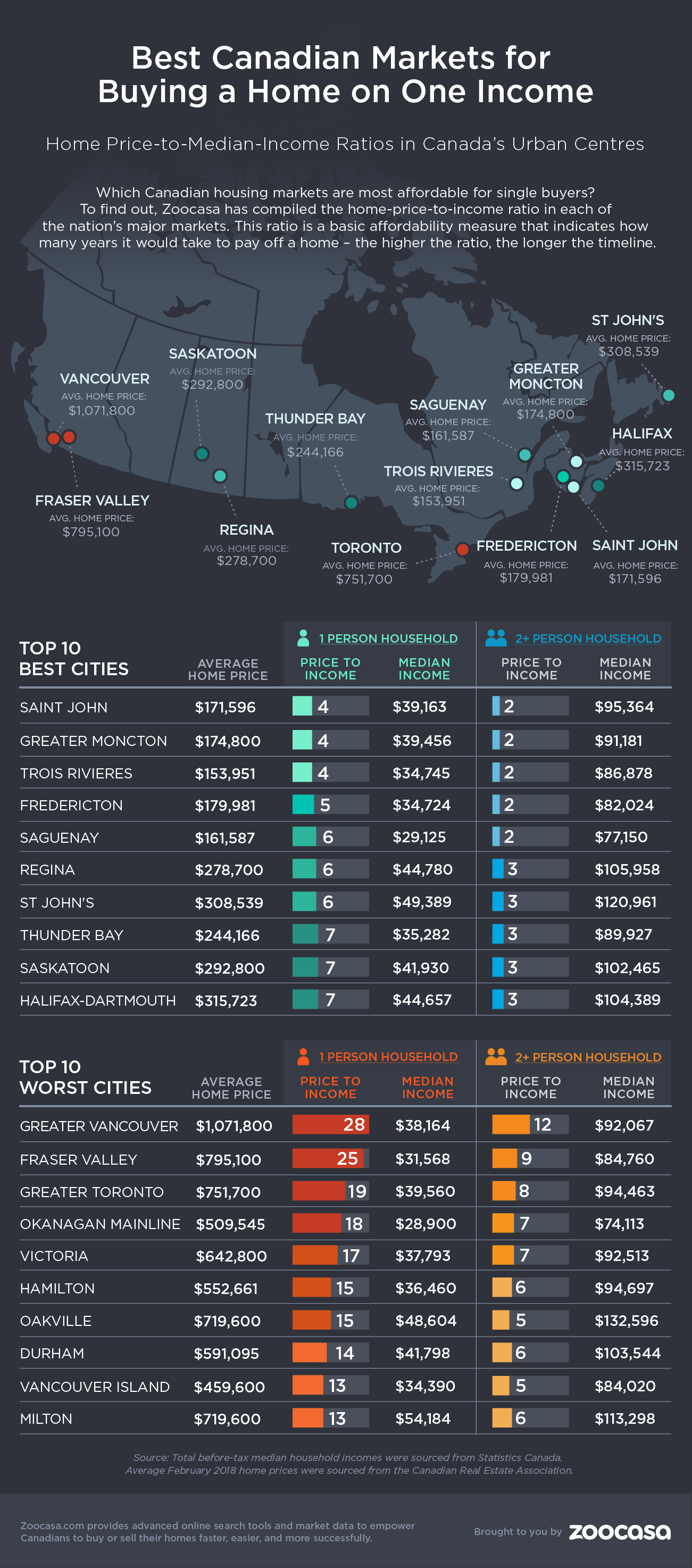

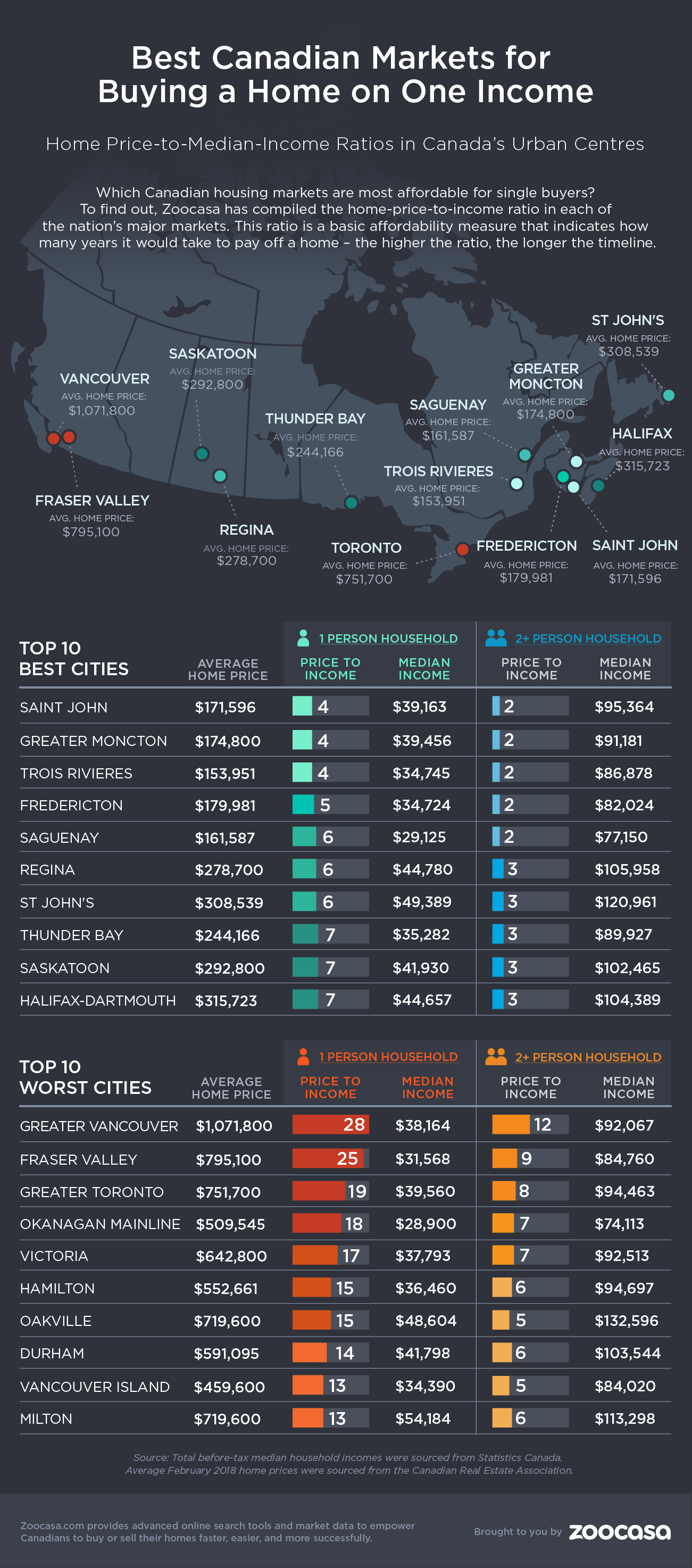

Zoocasa’s report examines various Canadian cities’ price-to-income ratio, an affordability measure that looks at how long it would take a homeowner to pay off their home if they contributed 100 per cent of their income to it. The longer the payment timeline, the higher the ratio.

According to the report, the best place to buy a home on a single income is Saint John, New Brunswick, where the average home costs $171,596 and the median income is $39,163, which gives the city a price-to-earnings ratio of four.

The 5 Most Affordable Home Markets

Saint John: 4 (average home price: $171,596, median one-person income: $39,163)

Greater Moncton: 4 (average home price: $174,800, median one-person income: $39,456)

Trois Riviers: 4 (average home price: $153,591, median one-person income: $34,745)

Fredericton: 5 (average home price: $179,981, median one-person income: $34,724)

Saguenay: 6 (average home price: $161,587, median one-person income: $29,125)

Not surprisingly, the cities with the hottest markets were the ones most out of reach for single income buyers.

And four out of the top five least affordable cities are located in British Columbia. Greater Vancouver leads the way with average home costing $1,071,800 and a median income of $38,164, giving the city a price-to-earnings ratio of 28, the highest in the country.

The 5 Least Affordable Home Markets

Greater Vancouver: 28 (average home price: $1,071,800, median one-person income: $38,164)

Fraser Valley: 25 (average home price: $795,100, median one-person income: $31,568)

Greater Toronto: 19 (average home price: $751,700, median one-person income: $39,560)

Okanagan Mainline: 18 (average home price: $509,545, median one-person income: $28,900)

Victoria: 17 (average home price: $642,800, median one-person income: $37,793)

“Though we expected to see Vancouver and Toronto up at the top of the most unaffordable regions list, we were surprised to see just how high the price-to-income ratio was in these cities,” said Haw. “This demonstrates that home ownership in Canada's major urban areas on a single income would be very difficult, if not impossible by measures of affordability.”

Haw says some potential buyers may have to consider more modest options when it comes to home ownership.

“Homebuyers may need to look at more affordable options within their respective regions to get into the market. That may mean a smaller condo apartment takes the place of the starter house in the more expensive regions of Canada,” she said.