Jan 30, 2018

Blackstone-led consortium to take majority stake in Thomson Reuters' F&R unit

Reuters

U.S. private equity firm Blackstone Group LP (BX.N) catapulted itself into the big leagues of Wall Street's financial information industry on Tuesday with the acquisition of a majority stake in the Financial and Risk business of Thomson Reuters Corp (TRI.TO).

The deal, announced by the companies in a statement, is Blackstone's biggest bet since the financial crisis. co-founder Stephen Schwarzman will go head to head against fellow billionaire and former New York mayor Michael Bloomberg, whose eponymous terminals are the market leader in providing traders, bankers and investors with news, data and analytics.

Under the acquisition, Blackstone acquire a 55-per-cent stake in a newly hived off F&R business, the statement said. Thomson Reuters will retain a 45-per-cent holding and will receive approximately US$17 billion, including about US$3 billion in cash and US$14 billion of debt and preferred equity issued by the new business, the companies said.

The Canada Pension Plan Investment Board and Singapore's GIC will invest alongside Blackstone but the statement did not specify the size of their stakes. The Canada Pension Plan Investment Board declined to comment. GIC could not immediately be reached for comment.

The new partnership will be managed by a 10-person board composed of five representatives from Blackstone and four from Thomson Reuters. The president and CEO of the new partnership will serve as a non-voting member of the board following the closing of the transaction. The companies did not say who that person would be.

Talks to sell Blackstone a stake in the F&R business first began in the summer, two sources familiar with the negotiations said.

The biggest sticking point during negotiations had been what the partnership would mean for Reuters News, the international news agency, which supplies the Thomson Reuters Eikon terminal with headlines, stories and analysis, said the two sources, who spoke on condition of anonymity.

In its statement, Thomson Reuters and the Thomson Reuters Founders Share Co, which has overseen Reuters' editorial independence since the company was first publicly listed in the 1980s, have agreed to "consequential modifications" to the Trust Principles that guide the news reporting division.

The statement did not give any more details.

A source familiar with the matter said there would be no change in the commitment of Reuters News to “independence,” “freedom from bias,” and supplying “reliable news” in keeping with the trust principles.

Kim Williams, chairman of the Thomson Reuters Founders Share Company, was not available for immediate comment.

Under the terms of the deal, Reuters News remains part of Thomson Reuters, along with its Legal and Tax and Accounting divisions.

The new F&R company will make minimum annual payments of US$325 million to Reuters to secure access to its news service, equating to almost US$10 billion. Thomson Reuters chief financial officer Stephane Bello told an investor call that the payment represented what F&R used to allocate to Reuters News.

Reuters also makes money selling news to broadcasters, websites, newspapers, and other media organizations around the world. In 2016, Reuters reported US$304 million revenue from its media business.

Thomson Reuters expects the transaction to close in the second half of 2018.

Thomson Reuters said it will use the bulk of the US$17 billion proceeds from the transaction, estimated at US$9 billion to US$11 billion, to buy back shares in a bid/tender offer to all common shareholders on the close of the transaction.

It said it will also use proceeds to pay down debt and invest in it Legal and Tax & Accounting units and make selective acquisitions.

Woodbridge, the investment vehicle of Canada’s Thomson family and Thomson Reuters principal shareholder, will participate in the bid/tender offer. Woodbridge intends to keep its 50 per cent to 60 per cent ownership of Thomson Reuters, the statement said.

Blackstone, which already has business relationships with most of the major banks on Wall Street, bought a small financial information business, Ipreo, in 2014.

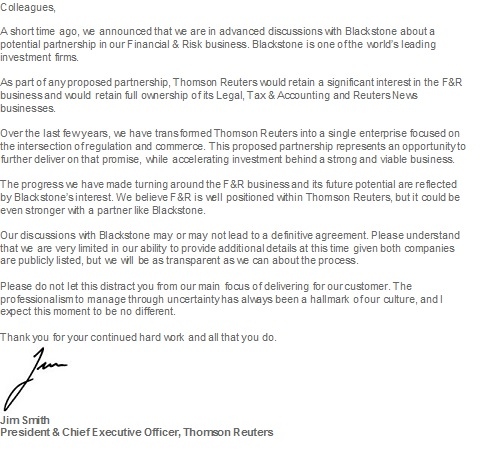

In a memo to employees sent earlier on Tuesday, Reuters president and CEO Jim Smith called the deal a chance to further the company's transformation into a "single enterprise focused on the intersection of regulation and commerce."

The full text of the memo can be seen below.

--With files from BNN