Home sales picked up in Toronto last month as some buyers leapt into action ahead of tough new mortgage rules that take effect in January.

There were 7,374 property sales across the Greater Toronto Area in November, marking an uptick from the 7,118 transactions registered in October.

"Similar to the Greater Vancouver experience, the impact of the Ontario Fair Housing Plan and particularly the foreign buyer tax may be starting to wane," said Toronto Real Estate Board President Tim Syrianos in a press release Tuesday, in reference to the Ontario government's 16-point plan to improve housing affordability.

"On top of this, it is also possible that the upcoming changes to mortgage lending guidelines ... have prompted some households to speed up their home buying decision."

The country's top banking regulator, the Office of the Superintendent of Financial Institutions, announced new lending guidelines this fall that will see stress tests applied to borrowers who take out uninsured mortgages, starting Jan. 1, 2018.

There was also some evidence that homeowners might be trying to cash out before the new rules take effect, as active listings of properties available for sale surged 110.6 per cent year-over-year in November.

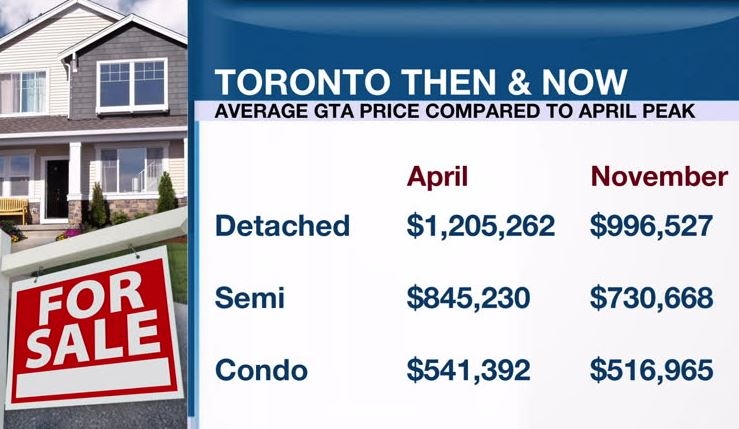

The average selling price across the GTA was $761,757 in November, compared with $780,104 in October.