Mar 31, 2017

TSX's tepid start to 2017 has index on par with Serbia, Croatia

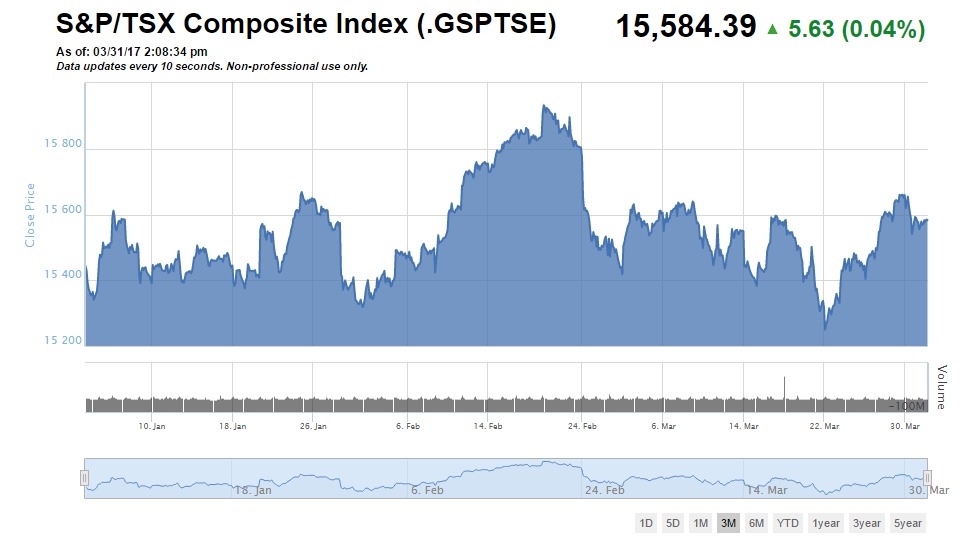

The Toronto Stock Exchange has eked out a modest 1.8 per cent return over the first quarter, underperforming its U.S. peers as oil prices fail to make a definitive break above US$50 per barrel.

The TSX’s start ranks it as the 83rd-best performer among global indices, sandwiched between Serbia’s Belgrade BELEX15 and Croatia’s Zagreb Crobex. Below, a look at how the benchmark Canadian index landed between those of a pair of former Yugoslavian republics.

Worst-Performing Stocks

| COMPANY | LOSS |

|---|---|

| Crew Energy (CR.TO) | - 34.1 % |

| Baytex Energy (BTE.TO) | - 30.8 % |

| Bonavista Energy (BNP.TO) | - 28.1 % |

| MEG Energy (MEG.TO) | - 26.9 % |

| Cenovus Energy (CVE.TO) | - 25.9 % |

Crew Energy is the lead laggard on the TSX in 2017, falling 34 per cent to start the year after swinging to a surprise fourth quarter loss. The company, which is 60 per cent weighted to natural gas, has suffered as a mild winter weighed on the underlying commodity price. Cenovus Energy’s record plunge in the wake of Thursday’s $17.7-billion acquisition of ConocoPhillips oil sands assets sent it into the fifth-worst slot, edging out Valeant Pharmaceuticals (VRX.TO).

Worst-Performing Sectors

| SECTOR | LOSS |

|---|---|

| Health Care | - 10.4 % |

| Energy | - 6.4 % |

| Consumer Staples | + 2.4 % |

But Valeant’s heavy weighting helped send the healthcare index to the worst performance among the TSX sectors, dragging the group to an 10 per cent drop. The energy index, which carries more weight for the overall index as one of the three key pillars of the TSX, was the second worst performer, as oil struggled to stage a meaningful recovery above US$50 a barrel and natural gas prices languished.

Best Performing Stocks

| COMPANY | GAIN |

|---|---|

| Ivanhoe Mines (IVN.TO) | + 82.7 % |

| Sierra Wireless (SW.TO) | + 67.8 % |

| Kirkland Lake Gold (KL.TO) | + 39.0 % |

| NexGen Energy (NXE.TO) | + 34.3 % |

| Pretium Resources (PVG.TO) | + 28.2 % |

The commodity trade was far kinder for the gold miners to kick off 2017, with three of the top five performers on the overall index coming from the group. Ivanhoe paces the group, benefitting from gold’s solid move above US$1,200 per ounce, and the company has also seen positive drill results from its operations in the Democratic Republic of the Congo. Sierra Wireless takes the number two slot on the list, as explosive demand growth for its cloud-based logistics software gives shares a boost.

Best Performing Sectors

| SECTOR | GAIN |

|---|---|

| Info Tech | + 7.0 % |

| Consumer Discretionary | + 6.7 % |

| Materials | + 5.8 % |

Sierra’s performance is a big factor in the outperformance of the Info Tech sector, pacing the index. Consumer Discretionary and Materials round out the top five, as the aforementioned strength in the price of gold pushed the latter group higher.