Apr 18, 2024

US Junk-Bond Funds Post Biggest Outflow in Over a Year

, Bloomberg News

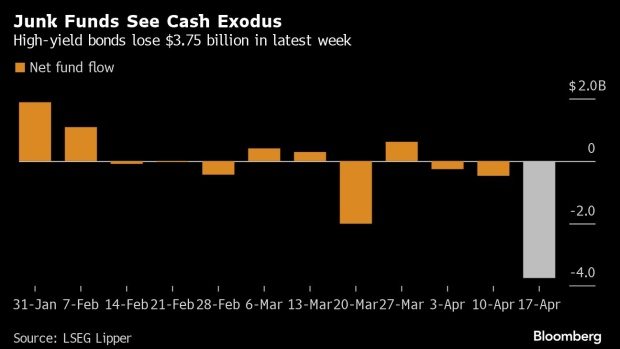

(Bloomberg) -- Funds that invest in US corporate high-yield notes saw the biggest outflow in more than a year as the Federal Reserve’s hawkish approach to inflation makes investors wary.

Investors withdrew $3.75 billion from junk bond funds in the week ending April 17, according to data from LSEG Lipper, the most in 14 months. Treasuries have sold off in April as solid economic readings and hawkish Fedspeak have reinforced speculation that interest rates will be higher for longer.

The spike in Treasury yields have pushed returns for both high-yield and investment-grade bonds into negative territory for April, according to Bloomberg indexes. Both classes are on pace for their worst monthly performance since September.

Funds that invest in short- and medium-term investment-grade notes saw their smallest inflow in four months during the latest week at $170 million, the LSEG Lipper data show.

Elsewhere, US leveraged loan funds added the least in 10 weeks, attracting a net $153.3 million.

--With assistance from Christopher DeReza.

©2024 Bloomberg L.P.