Apr 16, 2024

US Yields at 2024 Highs Lure Some Buyers Even as Shorts Dominate

, Bloomberg News

(Bloomberg) -- The highest US yields since November are beginning to attract some opportunistic buyers, even as negative sentiment remains firmly entrenched throughout the Treasury bond market.

Treasuries rose on Wednesday, sending two-year yields down about 4 basis points to 4.95%, and trimming some of the recent surge in rates.

The latest client survey from JPMorgan Chase & Co. showed that investors were net long on Treasuries by the most in three weeks as of Monday. Meanwhile, in the options market, traders appeared biased toward unwinding at least some of their bearish positions, potentially locking in profits as US two-year yields surged to as high as 5%. Simmering Middle East tensions may also be providing some support for the safety of government bonds — but not enough to spark a rebound.

Treasury bonds have slumped this month as traders responded to data showing continued economic strength and stubborn inflation by drastically scaling back expectations for Federal Reserve interest-rate cuts. Fed Chair Jerome Powell added to the malaise on Tuesday by saying the strong readings will likely keep the central bank on hold for longer.

The persistent negative tone in the market can be seen in the magnitude of the buildup of bearish positions in open interest patterns across two-year Treasury futures where new positions, rather than liquidations, have been apparent in 13 of the past 14 trading sessions as yields have climbed.

“Our futures positioning proxy suggests rates are biased higher, particularly at the front end,” Bank of America strategists including Meghan Swiber wrote in a note on Monday. They add that commodity trading advisers are also starting to spread out their short wagers to longer maturities, too.

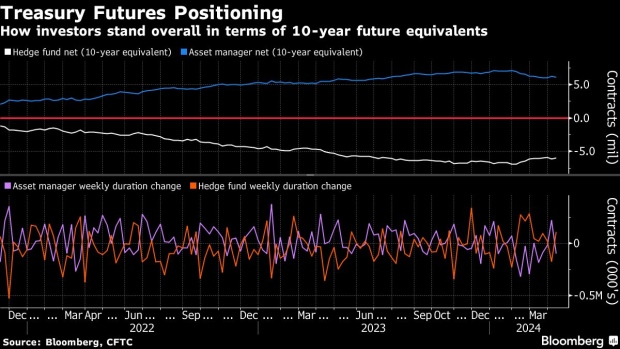

While the JPMorgan survey points to some recent dip buying, other data from the Commodity Futures Trading Commission suggests otherwise. Since the start of February CFTC data has shown asset manager net duration longs cut in eight of the past 10 weeks, including the most recent weekly data up through April 9.

Some traders are hedging their bearish bets. Elevated demand for protection against the possibility of aggressive rate cuts has been seen in the options market linked to the Secured Overnight Financing Rate, which closely tracks the central bank policy rate.

Here’s a rundown of the latest positioning indicators across the rates market:

Treasury Clients Add to Longs

JPMorgan’s survey of Treasury clients for the week up to April 15 showed longs rise 4ppts, shorts drop 6ppts and neutrals gaining 2ppts. The shift in positioning may reflect growing flight-to-quality concerns given last week’s report showed clients as net neutral — and not net long — for first time in almost a year.

Hedge Funds Covered Shorts into CPI

CFTC data up to April 9, a day before the latest US inflation report, showed that hedge funds unwound short positions, continuing a trend since the start of January. The latest round of covering was equivalent to roughly 112,000 10-year note futures equivalents, the biggest since Feb. 27. Since the start of the year, hedge funds’ duration short has been unwound in 11 out of 15 weeks. On the flip side, asset managers have been moderating net long positions over the same time period. In the latest data, “real money” accounts unwound almost 100,000 10-year futures equivalents to their net dureation long positions, the data shows.

It Remains Expensive to Hedge Bond Selloff

Despite Friday’s brief flight-to-quality bid into Treasuries, the cost of hedging a selloff in the long end of the curve remains elevated, especially in comparison to front- and belly futures. Recent flows in the options market have been biased toward hedging a bigger selloff, with standout trades including Monday’s $4.4 million wager targeting a 4.65% 10-year yield. Tuesday’s session highlights included a huge $18 million block sale in options, pointing to profit-taking on bearish positions with 10-year yields stretched to fresh yearly highs.

SOFR Options Most Active

The past week has seen elevated activity in the 94.625 strike with demand for Dec24 puts following flows including large buyer of the SFRZ4 95.00/94.625/94.25 put fly. Flows have also been active in the 94.6875 strike following activity such as buying in the SFRZ4 95.0625/94.875/94.6875 put tree. Heaviest liquidation over the week seen in the 94.875 strike following flows including buyer of the SFRU4 94.875/94.75 put spread.

SOFR Options Heat Map

The most populated SOFR options strike out to the Dec24 tenor is the 95.00 level, equivalent to a 5% rate, where heavy amounts of open interest can be seen in the Jun24 calls. Large amounts of open interest were also seen in the Jun25 calls on the 95.50 strike, which is the second most populated. Across other options, there remains a decent amount of open interest in Jun24 puts across the 94.75, 94.875 and 94.9375 strikes.

(Updates with Treasury moves in second paragraph.)

©2024 Bloomberg L.P.