Dec 29, 2017

We're number 72!: What held back the TSX in 2017

Canada’s largest cannabis company, a gold miner with improving fortunes in Australia and the nation’s latest tech darling saved the TSX Composite from an ignominious end to 2017. Canopy Growth, Kirkland Lake Gold and Shopify led the charge through 2017, a year when Canada’s benchmark index was underwater until late September. Though the composite did make repeated record highs in the waning days of the year, its 6 per cent return for 2017 badly lagged its global peers as the U.S. markets posted double-digit gains. The TSX ended the year as the 72nd best performer out of 93 global indices tracked, right behind the Casablanca stock exchange dominated by a single bank worth less than US$100 million.

Top Performers:

Canopy Growth (WEED.TO): +225.4 per cent

The cannabis craze that gripped Canadian capital markets over the course of 2017 helped drive Canopy Growth to the top spot on the TSX. The nation’s largest licensed producer more than tripled this year, leading the benchmark index as Canada inches towards legalization of recreational cannabis next summer. Revenue growth has gone on a tear, more than doubling in the most recent quarter, when the company sold more than a metric ton of cannabis. Canopy isn’t profitable, but Chief Executive Officer Bruce Linton is nonplussed. He’s repeatedly preached that now is the time for growth, not earnings, as the nascent sector gears up to supply the legal market.

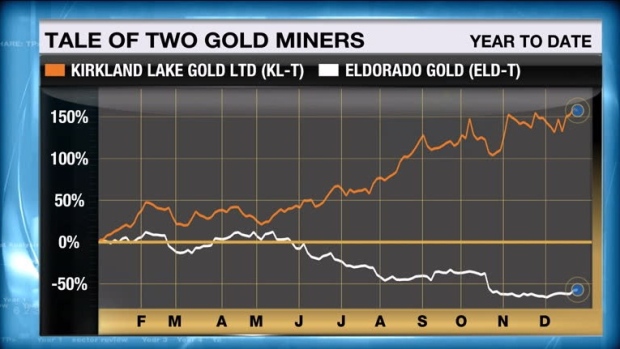

Kirkland Lake Gold (KL.TO): +174.5 per cent

Kirkland Lake Gold’s big bet on Australia paid off in 2017, with a pair of projects in that country lifting the company’s fortunes this year. Production surged 107 per cent this year, and the company’s all-in sustaining cost to pull an ounce of gold out of the ground is about US$500 lower than the current gold price. Additional exploration at its Fosterville mine in Southern Australia revealed reserves twice as large as originally forecast, at a significantly higher grade. Kirkland Lake shared some of its success with shareholders in 2017, first instituting a one-cent dividend in the spring, then doubling it this fall.

Shopify (SHOP.TO): +120.3 per cent

The latest flagbearer for the Canadian technology sector weathered a pointed attack from a prominent short seller to pull into the number three spot. Shopify shrugged off unproven allegations leveled by Citron Research’s Andrew Left, with shares more than doubling this year. Shopify Chief Executive Officer Tobi Lutke was initially mum on Left’s claims, but eventually fired back on Twitter, calling Left a “short-selling troll”. While the company has yet to offer more disclosure on one of Left’s main concerns about the rate of turnover among its merchant base, the company did succeed in proving to investors it can consistently increase revenue. Though profitability has proven to be sporadic, the top line grew more than 70 per cent in each quarter this year.

Air Canada (AC.TO): +89.3 per cent

Shares of the nation’s largest air carrier have proven to be dead money since the end of October, but Air Canada’s first-half surge was more than enough to power it to the fourth slot. Five trading days defined the year for the company, when shares rose more than nine per cent, accounting for the bulk of the gains. The rally got started in early May, when the company easily exceeded its own projections for the fourth quarter, but really hit high gear a week later when Air Canada announced plans to split from Aimia in favour of launching its own loyalty program. Record traffic for the Canada Day long weekend soon followed, and the company blew past already heightened profit expectations in late July. The final push came at the company’s September 20 investor day, where it unveiled ambitious growth projections through the end of the decade.

Martinrea (MRE.TO): +86.7 per cent

In spite of quarter after quarter of record profit, Martinrea still seems to be able to surprise the analyst community. Canada’s third-largest auto parts maker topped profit estimates in each quarter this year, bringing the run of record profitability to three years. Shares of the company responded in kind, posting their best trading days immediately in the wake of the earnings reports. Martinrea scored a number of new contracts in 2017, including production deals with Jaguar, BMW and Fiat-Chrysler expected to be worth $70 million per year. Though NAFTA negotiations loom large over the entire North American auto manufacturing sector, Martinrea is well diversified, with 13 divisions in Canada, the same number in the United States and nine in Mexico.

Health Care: +32.7 per cent

Canopy Growth’s dramatic run higher helped push the health care index to the strongest performance among the TSX’s 11 subgroups. But it wasn’t all up to the nation’s largest cannabis producer, with all four of the heavyweights of the group ending the year higher. A resurgent Valeant Pharmaceuticals, retirement home operator Chartwell and fellow marijuana firm Aphria joined Canopy for the ride higher. In spite of the strong performance, the health care group does little to move the needle on the TSX’s overall movement, as it’s the minnow of the index at just a 0.7 per cent weighting.

Consumer Discretionary: +20.4 per cent

The TSX’s most diverse group of companies grabbed the second spot, led by market standout Martinrea. The consumer discretionary index, which counts companies as diverse as the auto parts makers, Sleep Country Canada and casino operator Great Canadian Gaming, saw 17 of its 22 constituents end the year in the green. Joining Martinrea at the top were toy-maker Spin Master and BRP, which makes off-road vehicles. Lagging the pack was Canada’s largest theatre company, with Cineplex’s 27 per cent drop forming an ugly bookend to the group.

Industrials: +17.9 per cent

The TSX industrials round out the top three, led by firms with ties to the aerospace sector. Joining Air Canada among the top performers are Bombardier, Chorus Aviation and flight-simulator manufacturer CAE. Engineering and consultancy firms are also well-represented, with WSP Global and Aecon Group rising more than 30 per cent, the latter thanks to a controversial pending takeover by a Chinese conglomerate. Two of the three largest drags on the group became targets of California-based short-seller Marc Cohodes this year, with Badger Daylighting and Exchange Income Corporation both falling 15 per cent.

Worst Performers:

Energy: -10.0 per cent

Only a single subgroup ended the year in the red, but it was a big one. The collapse in Canadian natural gas prices sent the energy group, which accounts for about one fifth of the overall index, to a double-digit decline for the year. A mere 13 of its 50 constituents were able to eke out a positive showing in 2017. Though pure-play natural gas producers suffered the largest declines, Saskatchewan-focused Crescent Point Energy, embattled oil sands giant Cenovus and heavy oil producer MEG Energy were among the lead laggards for the year.

Real Estate: +5.8 per cent

The real estate group lagged the overall index, but not by much. The losers within the subgroup were primarily real estate investment trusts, many with exposure to the retail market. The group is also typically hampered by a rising rate environment, which raises the cost of borrowing to purchase new properties while simultaneously reducing the appeal of REITs as a source of yield during rock-bottom interest rate scenarios.

Utilities: +6.2 per cent

It speaks to the hefty influence the energy group has on the overall composite’s performance that the utilities subgroup can simultaneously outpace the index and be its third-worst performer. Much like the REITs, higher interest rates delivered by the Bank of Canada can be a drag on traditional yield stocks like the utilities. Superior Plus, TransAlta Renewables and Hydro One headline as the laggards of the group.

Crew Energy (CR.TO): -58.1 per cent

A one-two punch of weak natural gas prices and persistently low heavy oil prices sent Crew Energy to the mat in 2017. The company, which operates in the Montney gas fields straddling the Alberta-B.C. border and the heavy oil deposits near Lloydminster, suffered through a painful 2017, pushing Crew to the worst performance on the composite. Conditions in the Canadian natural gas market deteriorated to the point where the company was holding back shipments of natural gas from its British Columbian operations in a bid to wait out the price weakness.

Eldorado Gold (ELD.TO): -57.9 per cent

Eldorado Gold has two problems: Greece, and Turkey. In spite of being the largest foreign investor in Greece, Eldorado spent the year sparring with Prime Minister Alexis Tsipras’ regime over permits for a pair of key projects in the country, helping cut the company’s share price by more than half. The disagreement came to a head when Eldorado declared plans to mothball the projects until the matter can be resolved, clouding the company’s long-term future in the country. In the meantime, problems at Eldorado’s key Kisladag mine in Turkey prompted the company to cut its production forecast twice -- a significant problem given that the site accounts for about two thirds of Eldorado’s total production.

Peyto Exploration (PEY.TO): -53.0 per cent

Peyto Exploration wasn’t spared by the carnage in the natural gas space in 2017, though there is some light appearing at the end of the tunnel. Profit in the most recent quarter rose more than 90 per cent year-over-year, and the company was able to defend its dividend in spite of the low price environment. Much like Crew, Peyto held back some of its production as the Alberta benchmark price whipsawed over the course of 2017.

Birchcliff Energy (BIR.TO): -53.0 per cent

Once a market darling, Birchcliff suffered the same fate as the rest of the natural gas industry in 2017. Shares of the firm, which counts billionaire investor Seymour Schulich as one of its largest backers, were cut in half during the year. The company embarked on a number of asset sales in 2017, offloading about $148 million worth of holdings in a bid to bolster its balance sheet.

Tahoe Resources (THO.TO): -52.3 per cent

Geopolitical problems in Central America plagued Tahoe Resources during the back half of the year. Protestors descended on its Escobal mine in Guatemala in June amid a variety of issues, including unproven claims mining operations were causing seismic activity more than 20 kilometres away. Things went from bad to worse for the company later in the summer, when a Guatemalan court suspended its mining license over claims Tahoe failed to properly consult with Indigenous groups in its development of the site. The suspension was particularly damaging, given Escobal generates about 60 per cent of Tahoe’s free cash flow, and prompted the company to suspend its dividend. While the license was eventually reinstated, it’s been a slow bleed into the end of the year for the company’s share price.

Honourable mention:

Empire Co. (EMPa.TO)

What a difference a year makes. Shares of the parent company of Sobeys surged in 2017, after Empire Co. lost a third of its value last year. The company kicked off the new year with a bang, hiring former Canadian Tire Chief Executive Officer Michael Medline less than two weeks into 2017 with the mandate of cleaning up the mess left by a disastrous takeover of Safeway Canada. Medline has been aggressive in reworking the company, unveiling a plan to cut half a billion dollars’ worth of annual costs and streamlining operations.

Dishonourable mention:

Cineplex (CGX.TO)

Viewer fatigue with endless iterations of superhero sequels helped send the nation’s largest theatre operator to the third-worst showing among non-resource plays this year. Attendance and overall box office revenue suffered as the dearth of new ideas in Hollywood left Cineplex with its hands tied. However, the company has been diversifying its business to become less reliant on the vagaries of film studios, with Cineplex rolling out more of its Rec Room entertainment centres.