Mike Cagney’s Figure Technology Taps Tannenbaum as Its New CEO

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

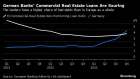

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Oct 17, 2017

Housing professionals aren't wasting time doing the math on what OSFI's stress tests for uninsured mortgages mean for how much house you can afford.

Ratehub.ca has done the arithmetic under two possible scenarios for families earning $100,000 annually.

According to its math, a family that can afford a home worth $726,939 under current rules by putting 20 per cent down with a five-year fixed mortgage rate of 2.83 per cent and a 25-year amortization would see its purchasing power plunge to $570,970 under the new stress test rules.

Under another scenario, Ratehub says that same family could currently afford a home worth $706,692 by making a 20-per-cent down payment on a five-year fixed rate of 3.09 per cent amortized over 25 years. Under the new stress testing requirements, Ratehub estimtes that family would only be able to afford a $559,896 home.