Jun 24, 2016

‘A lose-lose result’: Global leaders, businesses react to stunning Brexit outcome

BNN Bloomberg

Business and economic leaders around the world are sounding off after the United Kingdom voted to leave the European Union. Here's what they are saying:

3:45 p.m. ET

Douglas Porter, BMO Capital Markets chief economist

"The Brexit result is a net negative for the global growth outlook, but it's not a crippling blow. The initial financial market reaction was especially sour mostly because the market had become so convinced that Remain would win and not so much because it's a massive negative for the outlook."

Benjamin Tal, deputy chief economist at CIBC World Markets Inc.

"Given the economic uncertainty, it is difficult to see how the U.K. economy will avoid a recession."

Sherry Cooper, chief economist at Dominion Lending Centres

"For now, the most immediate impact will be lower interest rates... The Bank of Canada will wait and see what happens... If anything, continued very low interest rates could further boost already hot Toronto and Vancouver housing markets."

Bruce Cooper, TD Asset Management chief investment officer

"In the longer term, the key issue for investors is whether Brexit marks a turn toward nationalism... Equity investors particularly have benefited from globalization over many decades as companies have been able to move production to lower-cost jurisdictions and penetrate new markets, providing a significant long-term tailwind to earnings. A move in the other direction would exacerbate the challenges we have been highlighting for some time, including the persistent low-growth environment that is firmly in place today."

Colin Cieszynski, chief market strategist at CMC Markets Canada

"As in the aftermath of an earthquake, we may see significant aftershocks rock the markets in the coming days, but it appears the worst has passed for now."

1:10 p.m. ET

Bombardier spokesperson Marianella de la Barrera

“It is too early to speculate on potential outcomes or impacts of the U.K. now having voted to leave the European Union. …We will continue to work with the government and other industry stakeholders to create the necessary business environment to ensure our future success.”

12:43 p.m. ET

Brookfield Asset Management CEO Bruce Flatt

“As long term investors we remain committed to London and the U.K., and are confident that the U.K. will continue to attract international capital and be one of the leading business centres in the world.”

12:15 p.m. ET

Canada's Finance Minister Bill Morneau

“While some market and economic volatility can be expected, the Canadian economy is well placed and our financial institutions are well funded. Global markets are resilient and orderly, and we will continue to monitor developments in the world economy.

Scotiabank Group Head of Global Baking and Markets Dieter Jentsch

“Scotiabank has planned for all potential outcomes and we are confident in our ability to continue to serve our customers in both the U.K. and Europe.”

11:24 a.m. ET

Canada's Trade Minister Chrystia Freeland's statement

“Millions of Canadians have strong, personal connections with the United Kingdom and it is one of Canada's top trading partners globally. We want Britain to succeed and prosper, and – as we have said all along – we will continue to be a friend, partner, and ally.

“I was in touch early this morning with the EU Trade Commissioner, Cecilia Malmström, about our commitment to CETA and to deepening our trading relationship.

“We remain committed to growing global trade that is good for Canada's economy, good for the environment, good for labour, and good for people.”

Japan's Nippon Steel and Sumitomo Metal President Kosei Shindo

"We are greatly concerned for the negative impact this will have, not only on Britain and the EU but also on the global economy."

Goldman Sachs Chairman and CEO Lloyd Blankfein

"Goldman Sachs has a long history of adapting to change, and we will work with relevant authorities as the terms of the exit become clear."

Airbus CEO Thomas Enders

"This is a lose-lose result for both Britain and Europe ... We will review our U.K. investment strategy, like everybody else will."

JD Wetherspoon Pubs Founder and Chairman Tim Martin

"Anxiety about the economic effects of independence during the campaign was misplaced. The U.K. will thrive as an independent country, making its own laws, and we will work with our good friends and neighbors in Europe and elsewhere to ensure a positive outcome for all parties."

9:19 A.M. ET

Prime Minister Justin Trudeau

"The U.K. and the EU are important strategic partners for Canada with whom we enjoy deep historical ties and common values. We will continue to build relations with both parties as they forge a new relationship.

"Prime Minister David Cameron indicated today that he will resign by the fall. On behalf of all Canadians, I would like to thank him for being such a close ally and good friend to our country. We wish him well."

9:11 a.m. ET

U.S. Federal Reserve statement

The Federal Reserve is prepared to provide dollar liquidity through its existing swap lines with central banks, as necessary, to address pressures in global funding markets, which could have adverse implications for the U.S. economy.

9:07 a.m. ET

CIBC World Markets' Head of Portfolio Strategy Ian de Verteuil

"While the risks of Brexit have been well detailed, the reality was that many financial markets participants were focused on the economic logic of staying within the EU rather than the apparent frustration of many with status quo. This meant that little if any probability of this event was priced into equity markets, fixed income markets or currencies.

As such, today will be a torrid day with many risk-off assets performing well. A handful of Canadian names will be affected ... We believe that opportunities will develop - but it is probably best to see where the market settles."

Royal Bank of Canada spokesperson's statement

“It is still too early to comment on what our strategy would be in a changed environment, but the U.K. and Europe are strategically important to RBC and we are committed to the region. We continue to monitor the situation closely. In accordance with good business practice, we are reviewing and considering various scenarios as part of our internal stress-testing and ongoing exposure management; we are confident that we will be able to support our clients whatever the outcome of the negotiations.”

8:53 A.M. ET

G7 Finance Ministers and Central Bank Governors' joint statement

"We, G7 Ministers and Governors, respect the intention expressed today by the people of the United Kingdom to exit from the European Union... G7 central banks have taken steps to ensure adequate liquidity and to support the functioning of markets. We stand ready to use the established liquidity instruments to that end."

8:52 a.m. ET

Bank of Canada spokesperson Martin Bégin

“We are monitoring the situation closely.”

8:46 A.M. ET

IMF Managing Director Christine Lagarde

“We urge the authorities in the U.K. and Europe to work collaboratively to ensure a smooth transition to a new economic relationship between the U.K. and the EU, including by clarifying the procedures and broad objectives that will guide the process.

“We strongly support commitments of the Bank of England and the ECB to supply liquidity to the banking system and curtail excess financial volatility. We will continue to monitor developments closely and stand ready to support our members as needed.”

8:15 a.m. ET

EU leaders' joint statement

"We will stand strong and uphold the EU's core values of promoting peace and the wellbeing of its peoples ... together we will address our common challenge to generate growth, increase prosperity and ensure a safe and secure environment for our citizens ...

"We now expect the United Kingdom government to give effect to this decision of the British people as soon as possible, however painful that process may be. Any delay would necessarily prolong uncertainty ...

"As regards the United Kingdom, we hope to have it as a close partner of the European Union also in the future ... Any agreement, which will be concluded with the United Kingdom as a third country, will have to reflect the interests of both sides and be balanced in terms of rights and obligations."

German Chancellor Angela Merkel

"Today is a setback for ... the European integration process ... Germany has a particular interest and a particular responsibility in European unity succeeding."

Chinese Foreign Ministry Spokeswoman Hua Chunying

"The impact will be on all levels, not only on relations between China and Britain ... China supports the European integration process and would like to see Europe playing a proactive role in international affairs."

7:48 a.m. ET

Aimia, in a company statement

“In the near term, the company expects a period of uncertainty to prevail in the U.K. as the government determines its position with respect to the EU.

Over the longer term, the company will evaluate the impact, if any, of the U.K.'s move to leave the EU to the business climate, regulatory environment, and trade flows.”

CGI Group spokesperson Lorne Gerber

“We live and work in dozens of communities across the U.K. The impact of this historic decision is varying as we engage directly with our U.K. members and clients to ensure we have appropriate support in place as Brexit sets in.”

6:46 a.m. ET

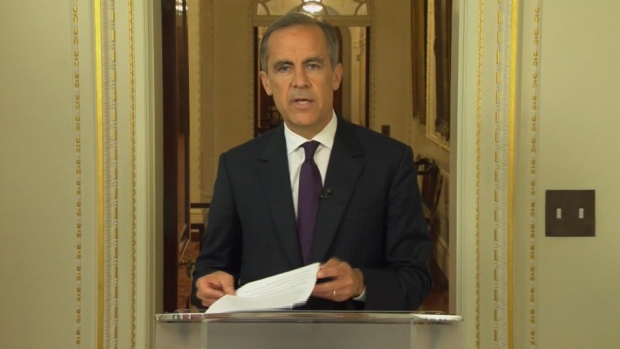

Bank of England Governor Mark Carney

"A few months ago, the Bank judged that the risks around the referendum were the most significant, near-term domestic risks to financial stability. To mitigate them, the Bank of England has put in place extensive contingency plans... We have taken all the necessary steps to prepare for today's events. In the future we will not hesitate to take any additional measures required to meet our responsibilities as the United Kingdom moves forward."

Germany's Vice Chancellor and Economy Minister

"Damn! A bad day for Europe."

European Central Bank

"Following the outcome of the U.K. referendum, the European Central Bank (ECB) is closely monitoring financial markets and is in close contact with other central banks.

The ECB stands ready to provide additional liquidity, if needed, in euro and foreign currencies. The ECB has prepared for this contingency in close contact with the banks that it supervises and considers that the euro area banking system is resilient in terms of capital and liquidity.

The ECB will continue to fulfil its responsibilities to ensure price stability and financial stability in the euro area."

Great-West Lifeco CEO Paul Mahon

"Our companies in Europe have strong, stable businesses and a diversified investment portfolio. They are appropriately capitalized. We remain committed to these markets."

Deutsche Bank CEO John Cryan

“…We cannot help but feel disappointed at the outcome of the UK referendum on membership of the EU. … the uncertainty created by the referendum’s results will be a challenge.”

Deutsche Boerse Chairman Joachim Faber

““The decision of the U.K. to leave the EU makes it ever more important to maintain and foster ties between the U.K. and Europe. We are convinced that the importance of the proposed combination of Deutsche Börse and LSEG has increased even further for our customers and will provide benefits for them as well as our shareholders and other stakeholders.”

IHS Global Insight economist Howard Archer

"Major economic and political uncertainty will be a fact of life for some considerable time, likely weighing down markedly on business and household confidence and behaviour, so dampening corporate investment, employment and consumer spending."

With files from Reuters and The Canadian Press