Jan 22, 2024

AI excitement still making market waves in 2024: Larry Berman

By Larry Berman

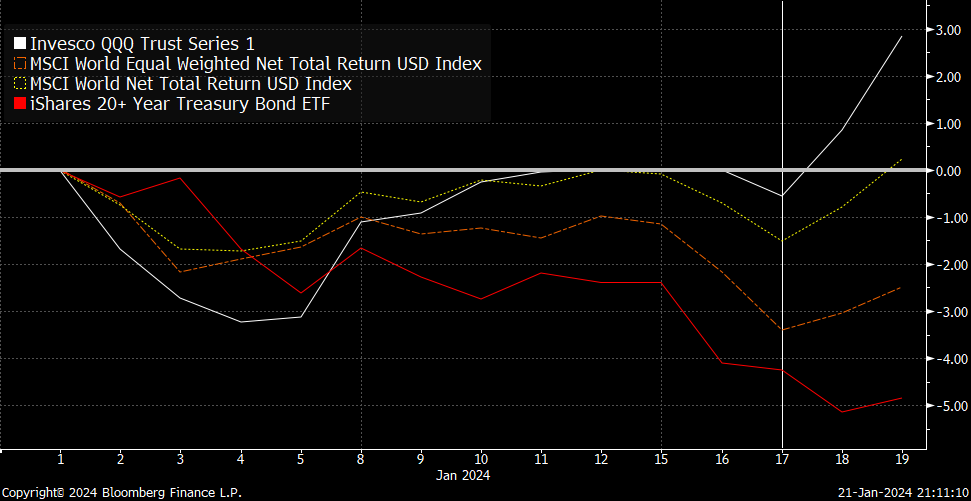

When we look at the price action of some key market indexes year-to-date, we see long bond yields rising and that the average stock down. That was until Taiwan Semiconductor excited the AI crowd again and got big tech surging late last week.

It’s exciting to contemplate AI’s impact on markets, growth and productivity.

Goldman Sachs reported last week that hedge funds piled into AI names and sold and shorted energy, health-care and utilities. It was their most active trading week in five months. Investment in AI startups is coming from everywhere. In 2023, Microsoft, Nvidia, Amazon, Google invested about US$25 billion, representing eight per cent of all venture investment in AI and data related companies. There is no end in sight for the excitement and trying to time the top seems like a bad idea.

One interesting observation is that the AIQ (Global X AI and Tech ETF) has not made a new high compared to the S&P 500 and NASDAQ 100, which made new highs last week. This divergence merits close scrutiny. The biggest pain for AI and tech came during the first part of the rate hike cycle in 2022 and in the third quarter of 2023, when there was bearish price action in long bonds. Last week, the sector clearly bucked that trend.

Follow Larry:

YouTube: LarryBermanOfficial

Twitter: @LarryBermanETF

Facebook: @LarryBermanETF

LinkedIn: LarryBerman

www.etfcm.com