Apr 22, 2024

An Overlooked FX Rally in Latin America Has Its Days Numbered

, Bloomberg News

(Bloomberg) -- It’s the end of the “super peso,” but not the one that has grabbed all the headlines.

While Mexico’s currency gained the epithet in 2023 with a 15% jump, the best among majors, its less-traded counterpart in Colombia was up by 11 percentage points more in the same period. In the past 12 months, the Colombian currency is up 15%, compared with Mexico’s 4.6% advance.

Now that success is coming to an end, with analysts at Natwest Markets and BBVA saying the rally has gone too far. A shrinking rate differential with the US — as the Colombian central bank cuts borrowing costs and the Federal Reserve turns more cautious — is starting to weigh on the currency, while local risks including disputed economic reforms lurk in the background.

“I am bearish COP at these levels,” said Alvaro Vivanco, head of emerging-market strategy at Natwest Markets. Political risk “is not properly priced in, and the effects of the oil rally can be eliminated with a stronger dollar overall.”

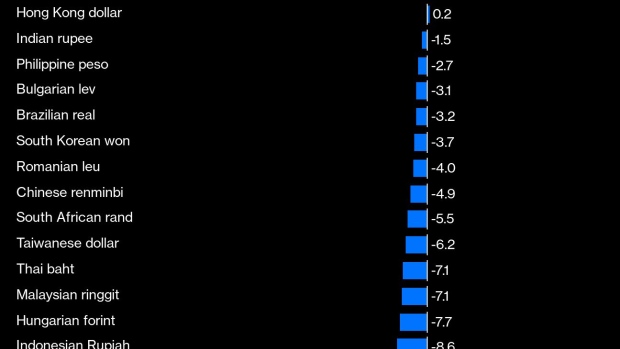

Citigroup ended its overweight recommendation on both the Mexican and Colombian pesos last week, saying the recent underperformance of Latin American currencies was “palpable” as “risk-aversion” hit regional markets.

The Colombian peso had lured carry traders as the key interest rate peaked at 13.25% and declined slowly to 12.25% over the 12 months. The currency also benefited from a surge in prices of crude oil, one of the country’s main exports and a reduction in political risk after the reform agenda of leftist President Gustavo Petro stalled.

Now, prospects for higher-for-longer interest rates in the US, coupled with geopolitical risks in the Middle East have investors scrambling for security, and carry traders exiting positions across developing nations. The Colombian peso has weakened more than 5% against the dollar in the past 10 sessions, falling back from a two-year high set on April 8.

Read More: Massive Global Carry Trade Unwinding Hits the ‘Super Peso’

On top of that, discussions about an overhaul of Colombia’s pension system could add to volatility and hurt the currency, said Alejandro Cuadrado, head of foreign-exchange strategy at BBVA in New York.

And President Petro hasn’t stopped there. He also surprised markets last month by proposing a newly elected assembly to rewrite the constitution. At the same time, his government expanded it’s fiscal deficit target for the year to 5.3%, from 4.3% in 2023.

“Its appreciation has been too great,” strategists led by Cuadrado wrote in a report published on April 3. “The risk premium has essentially been entirely priced out.”

Sink or Swim

Don’t expect a collapse in the peso though, especially given the recent rally in energy prices.

“With USDCOP and oil prices at these levels the government will have room to outperform fiscal deficit projections, assuaging concerns over credit risk,” said Armando Armenta, emerging market strategist at AllianceBernstein.

READ: Top Mexico Peso Forecaster Sees World-Beating Rally Losing Steam

Some also see inflation as too high to enable steep rate cuts — at least for now. For Bartosz Sawicki, an analyst at Polish brokerage Cinkciarz.pl and one of the most accurate forecasters for the currency in the first quarter, the peso will stay strong but won’t attract investors to the same extend that it did last year.

Rate cuts “won’t become a big issue for the currency, won’t put the peso under severe pressure,” Sawicki said. “But it’ll have limited upside potential.”

--With assistance from Davison Santana.

©2024 Bloomberg L.P.