Apr 9, 2024

Arb Traders See Slow Deal Revival Amid Rates, Antitrust Worries

, Bloomberg News

(Bloomberg) -- Merger-arbitrage investors say that a rebound in deal flow from last year’s doldrums is on shaky ground in the face of elevated interest rates, persistent antitrust concerns and election-year politics.

That’s according to a Bloomberg News survey of 15 merger-arbitrage and event-driven desks, analysts, brokers and fund managers, who said the mergers-and-acquisitions business in the US was less robust than they expected after a surge to start 2024.

Granted, the value of announced transactions just exceeded $300 billion for the second straight quarter — levels last seen in 2022, data compiled by Bloomberg show. But the revival was front-loaded and inflated by a burst of megadeals at the start of the year, including a couple eclipsing $30 billion. The momentum fizzled in March, fueling concern that the conditions weren’t yet ripe for a sustained recovery that would bring a busier slate of M&A stocks to bet on.

The mixed picture underscores how the Federal Reserve’s move to keep interest rates higher for longer, dashing expectations for a pivot to policy easing by mid-year, has led to a prolonged tricky backdrop for dealmaking. That, combined with the Biden administration’s antitrust push and the presidential election looming in November, are the keys to the merger-arb outlook, survey respondents said.

“Recently we seem to have had several deals that were close to being inked which fell apart last minute because of a bid-ask gap that could not be bridged,” said Chris Colpitts, a merger-arbitrage specialist at TD Cowen. “Uncertainty around the election and Biden’s antitrust policy are not going to change near-term, so the only way we see a meaningful increase in deals is if we gain consensus on the trajectory of interest rates.”

Uneasy Bunch

That sort of clarity doesn’t appear to be imminent, as strong economic data has led Fed officials to push back against the need for rate cuts any time soon.

The upshot is that many of the Bloomberg survey’s respondents are still uneasy about the M&A environment this quarter and beyond.

Early this year, JetBlue Airways Corp.’s acquisition of Spirit Airlines Inc. and iRobot Corp.’s sale to Amazon.com Inc. fell apart over antitrust challenges, prompting traders to fret that regulators would be re-emboldened after suffering big losses in court last year.

There’s also been an increase in the number of deals that include reverse-termination fees, to be paid by prospective buyers in transactions that fail because of antitrust or regulatory issues, said Brett Buckley, a strategist at WallachBeth Capital. Among about 40 large public pending transactions that he’s tracking, roughly 40% have such fees tied to regulatory factors, whereas 25% is a more typical level, he said.

“That underlines a once-again rising concern there,” he said.

And then there’s the saga around a proposed takeover of United States Steel Corp. by Nippon Steel Corp., which gave investors a fresh reminder of how some deals can get caught up in election-year politics.

President Joe Biden has said the company should stay in US hands. Meanwhile, former President Donald Trump, the presumptive Republican nominee, has pledged to block the deal outright.

Shopping List

But it’s not all gloomy for investors wagering on the outcome of deals.

Some pockets of the market, such as biotech and oil and gas, are seen as facing less regulatory scrutiny and likely to produce more tieups and takeovers, some survey respondents said.

Consumer-cyclical deals, such as Home Depot Inc.’s proposal to buy building-products distributor SRS Distribution Inc., are looking like another hot area, and they dominated last month, according to Bloomberg Intelligence’s Andrew Silverman.

Read more: Cyclicals, Energy M&A Suggests Pessimism Among Dealmakers

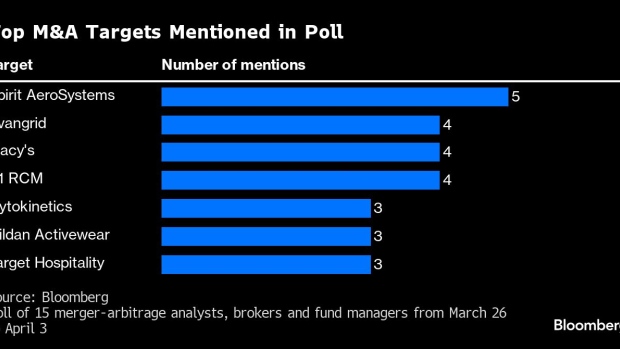

As for individual names, Spirit AeroSystems Holdings Inc., Avangrid Inc., Macy’s Inc. and R1 RCM Inc. are viewed as the most likely takeover targets, according to the Bloomberg survey, which was conducted from March 26 to April 3.

Five of the 15 respondents were confident that a deal around Spirit AeroSystems will materialize in the near-term, as the company is at the center of quality issues affecting 737 Max Jets. It’s in separate discussions with Boeing and Airbus about a potential deal.

Read more: Spirit Aero, Avangrid, Macy’s Are Top Q2 M&A Targets: Survey

©2024 Bloomberg L.P.