Apr 10, 2024

Australia Starts First Green Bond Marketing as Premiums Dry Up

, Bloomberg News

(Bloomberg) -- Australia will begin marketing its first-ever green bond issuance Thursday as a swath of sovereign issuance narrows the premiums investors pay to hold sustainable debt.

The nation’s government will seek to issue around A$7 billion ($4.6 billion) worth of green bonds maturing in June 2034, according to a presentation released Wednesday. The first bond will be syndicated after officials have completed roadshows in Australia, Asia and Europe. Other maturities will be issued over time.

Australia is joining a host of sovereigns tapping sustainable finance markets in a bid for cheaper funding costs through the so-called greenium, or premium to hold green debt. The yield on the nation’s benchmark 10-year note has jumped more than 90 basis points the past year, the second most in the developed world, according to data compiled by Bloomberg.

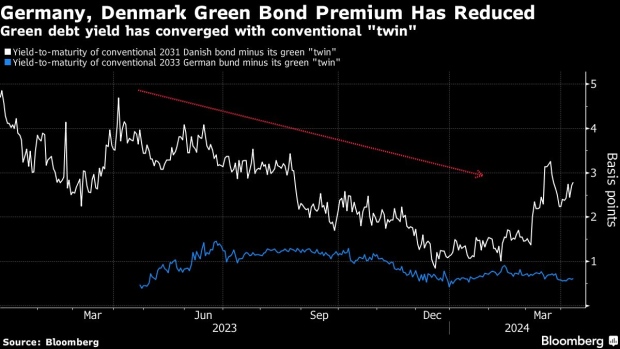

Greeniums however are starting to erode after sovereigns made up 40% of a record $187.7 billion in green issuance last quarter. In New Zealand, “it’s hard to discern if its 10-year green bond has any premium priced, while UK, Canada, and Germany have modest greeniums at best,” said Martin Whetton, head of markets strategy at Westpac Banking Corp. in Sydney.

Australian issuance may be similar as few investors don’t already have exposure to its sovereign debt, Whetton wrote in a note to clients. Fair value could be as little as 0.5 basis points, he added.

Proceeds of the green bonds will be used to accelerate energy transition including hydro-power and marine renewable energy, the government said.

Some investors may be hesitant to buy the debt given the nation remains among the highest per-capita carbon emitters in the world. Australia’s emission reduction policies and national targets are “insufficient” in meeting its Paris Agreement obligations, according to Climate Action Tracker.

Investor interest will depend on further details on the use of proceeds, according to Philip McNicholas, Asia sovereign strategist at Robeco. For now, the bond is likely to be supported as its structure looks in line with international norms, he said.

©2024 Bloomberg L.P.