Mar 18, 2024

BAE Systems Eyes at Least $4 Billion to Fund Ball Aerospace Purchase

, Bloomberg News

(Bloomberg) -- UK defense company BAE Systems Plc is sounding out investors for a corporate bond sale that could top $4 billion to help refinance a bridge loan it used to acquire Ball Aerospace, according to people familiar with the matter.

The firm agreed to buy Ball Aerospace in August in a $5.6 billion deal as a way to reach into space, a frontier the company predicts will become increasingly important in warfare. It marked the biggest purchase in the firm’s history. The final size of the bond offering will be determined on the day of the sale.

The bond sale will refinance a $4 billion facility taken out by the company in August. It’s the latest in a slew of deals earmarked for mergers and acquisition financings after the worst year in a decade for buyout funding.

BAE Systems and Bank of America Corp., which coordinated investor calls for the sale Monday, did not immediately reply to requests for comment.

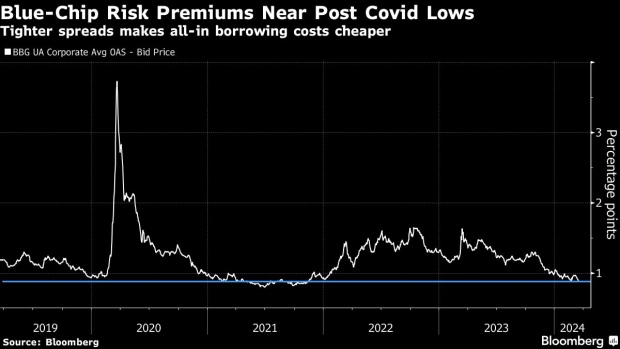

Borrowers are rushing into corporate bond markets at the fastest clip on record to lock in financing while spreads are tight, keeping all-in borrowing costs lower. Companies such as Bristol Myers Squibb, Cisco Systems Inc. and AbbVie Inc. have been able to lure outsized orders for offerings tied to mergers and acquisitions.

Read More: Bond Markets Are Flooded With Deals to Fund M&A: Credit Weekly

Sales momentum is extending this week ahead of the Federal Reserve’s rate decision Wednesday, which could slow the flow of new bond issuance. Eight borrowers tapped the bond market on Monday with $25 billion to $30 billion of issuance expected this week.

Moody’s Ratings upgraded BAE Systems’ credit grade at the end of February to Baa1, three steps above speculative grade, from Baa2, citing strong growth prospects and an expectation the company will strengthen its credit ratios again following the largely debt-financed acquisition.

--With assistance from Brian Smith.

©2024 Bloomberg L.P.