Apr 22, 2020

Brent oil trades near 21-year low, spreading pain across markets

, Bloomberg News

Oil in London traded near a 21-year low as the global benchmark was sucked into the rout that sent U.S. futures below zero for the first time ever this week.

Brent for June delivery slumped as much as 17 per cent, before paring losses by about US$4. West Texas Intermediate crude edged lower in New York, having lost almost half its value on Tuesday. Prices have been sliding amid fears that the massive glut that sent May WTI to a record low of minus US$40.32 on Monday is only going to get worse.

With global demand crushed by coronavirus lockdowns, concerns that the unwanted oil is going to overwhelm storage capacity have triggered a selling frenzy. Oil ministers from the OPEC+ coalition held an unscheduled conference call on Tuesday to discuss the rout, though a closing statement signaled they didn’t settle on any new policy measures.

The alliance agreed to slash production by about 10 million barrels a day earlier this month, but the cuts won’t kick in until May. Even then, they won’t be enough to balance out the demand destruction from the virus in the short term, which could be as high as 30 million barrels a day.

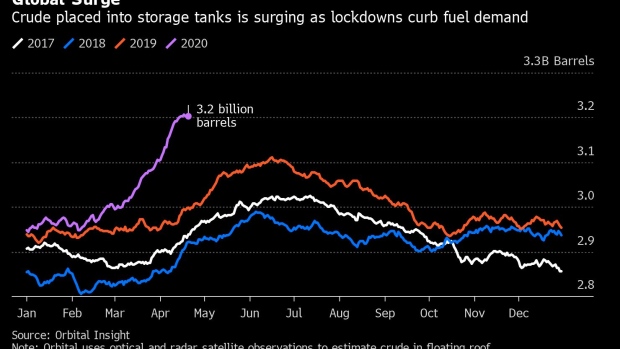

Global Surge

There are signs that the stunningly low prices are here to stay as supply dwarfs consumption. Royal Vopak NV, the world’s biggest independent storage company, said almost all of its space is sold, while Clarksons Platou said floating storage is filling at an “unprecedented pace.” Traditional oil bull Pierre Andurand warned crude could tumble below zero again and described the market as dangerous to trade in.

The rout is leaving the United States Oil Fund, the world’s biggest crude-tracking vehicle, at risk of becoming another casualty of the crisis. The fund has scrambled to move its holdings into longer-dated contracts among measures forced on it in the last few days. The value of its assets fell by more than US$1 billion on Tuesday.

Meanwhile, Interactive Brokers LLC announced an US$88 million provisional loss after customers holding long positions in May WTI at expiration triggered losses in excess of the equity in their accounts. In South Korea, the meltdown froze the trading system of brokerage Kiwoom Securities Co. as it failed to recognize negative prices.

Prices:

- Brent for June settlement fell as low as US$15.98 a barrel, the lowest since June 1999, and was at US$19.77 as of 13:08 p.m. in London

- WTI for June fell 8 cents to US$11.49 a barrel

- The Dated Brent benchmark, a global reference for almost two-thirds of the world’s physical flows, plunged to US$13.24 a barrel on Tuesday, the lowest since 1999, according to price reporting service S&P Global Platts. That means key European and African crude streams including Urals and Bonny Light will now sell under US$10, as they trade at a discount to the Dated Brent benchmark.

U.S. Stockpiles

Inventories at the biggest U.S. storage hub in Cushing, Oklahoma, are at the highest since 2017 and are expected to rise further. The industry-funded American Petroleum Institute reported that nationwide crude stockpiles rose 13.2 million barrels last week and supplies at Cushing added almost 5 million barrels, according to people familiar with the data. Meanwhile, Indian fuel tanks are now 95 per cent full, according to officials at three state-owned refiners.

“The dive below zero was more than just a technical quirk and could repeat itself if storage constraints intensify,” said Stephen Brennock, an analyst at broker PVM Oil Associates in London.

Other oil-market news

- The historic crash in crude prices is driving U.S. shale into full-on retreat with operators halting new drilling and shutting in old wells, moves that could cut output by 20 per cent for the world’s biggest producer of oil.

- Oil’s plunge below zero hasn’t just sent shockwaves through the industry. It has also literally broken the models that many traders rely on to calculate risk.

- Oil trader Hin Leong Trading (Pte) Ltd. plans to shift management away from its founding family to PricewaterhouseCoopers LLP as it prepares to withdraw an application for court protection from creditors, according to people familiar with the matter.

--With assistance from Dan Murtaugh, Aaron Clark and James Thornhill.