Apr 16, 2024

Brief Yen Surge Shows Traders Highly Sensitive to Intervention

, Bloomberg News

(Bloomberg) -- The yen’s sudden surge Tuesday was likely the result of traders increasingly sensitive to the risk of currency intervention by Japanese policymakers and not any official action in foreign-exchange markets, according to Nomura Plc.

Dollar-yen witnessed a brief reversal in New York morning trading, falling from 154.76 to a session low of 154.04 within a matter of minutes, before giving back most of that drop. With the pair at a 34-year high and the uptrend in dollar-yen intact, traders are mindful of any sharp moves that could be Japan’s Ministry of Finance intervening — something that last happened in September and October of 2022.

“The market is becoming more sensitive to sudden falls in USD/JPY, as the pair has approached the milestone level of 155,” Nomura currency strategists Yujiro Goto, Yusuke Miyairi and Jin Moteki wrote in a report Tuesday. “We place more importance on the fact that USD/JPY did not show a continued fall after the initial drop,” they added, noting that the sharp move could make the market more aware of potential intervention and “limit the pace of ongoing yen depreciation.”

At Monex Inc., foreign-exchange trader Helen Given agreed that the price action for yen Tuesday was the result of markets increasingly sensitive to intervention risk. “As we move toward USD/JPY at 155, traders are jumping on any dip they see so they don’t get hung out to dry,” Given said.

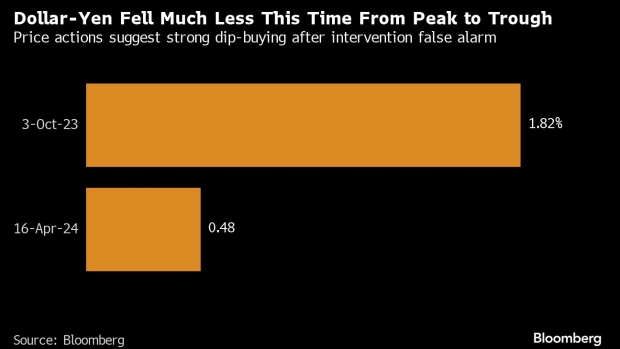

Nomura strategists said the move was reminiscent of another brief, yet bigger drop in dollar-yen last October, which at the time also raised questions about potential intervention by the Ministry of Finance. Official data later confirmed there had been no direct, official involvement in foreign-exchange markets.

Read more: BofA Cranks Up Dollar-Yen Forecast on Delay in Fed Rate Cuts

One reason traders are focused on the 155-per-dollar level is options expiries, which have helped reinforce the mark as a key near-term barrier against any upward moves in dollar-yen. Recent data from The Depository Trust & Clearing Corporation point to significant amounts of options expirations taking place with strikes at or slightly above 155 in recent days.

Any intervention could push dollar-yen lower and will likely be effective given crowded bearish yen positioning, according to Chidu Narayanan, chief APAC strategist at Wells Fargo Securities in Singapore. Still, “any dip is likely to be bought into, renewing the upward move,” he cautioned in a client note published before the dollar-yen drop Tuesday morning.

The price action seemed to reaffirm Narayanan’s view. Tuesday’s dollar-yen drop from session high to low was less than 0.5%, before traders aggressively bid the pair up. On October 3, the peak-to-trough move was much more intense at over 1.8%.

©2024 Bloomberg L.P.