Feb 21, 2024

Canada's oil boom threatens to bring back pipeline shortages

, Bloomberg News

Oil rises as Red Sea attacks on ships cause disruptions

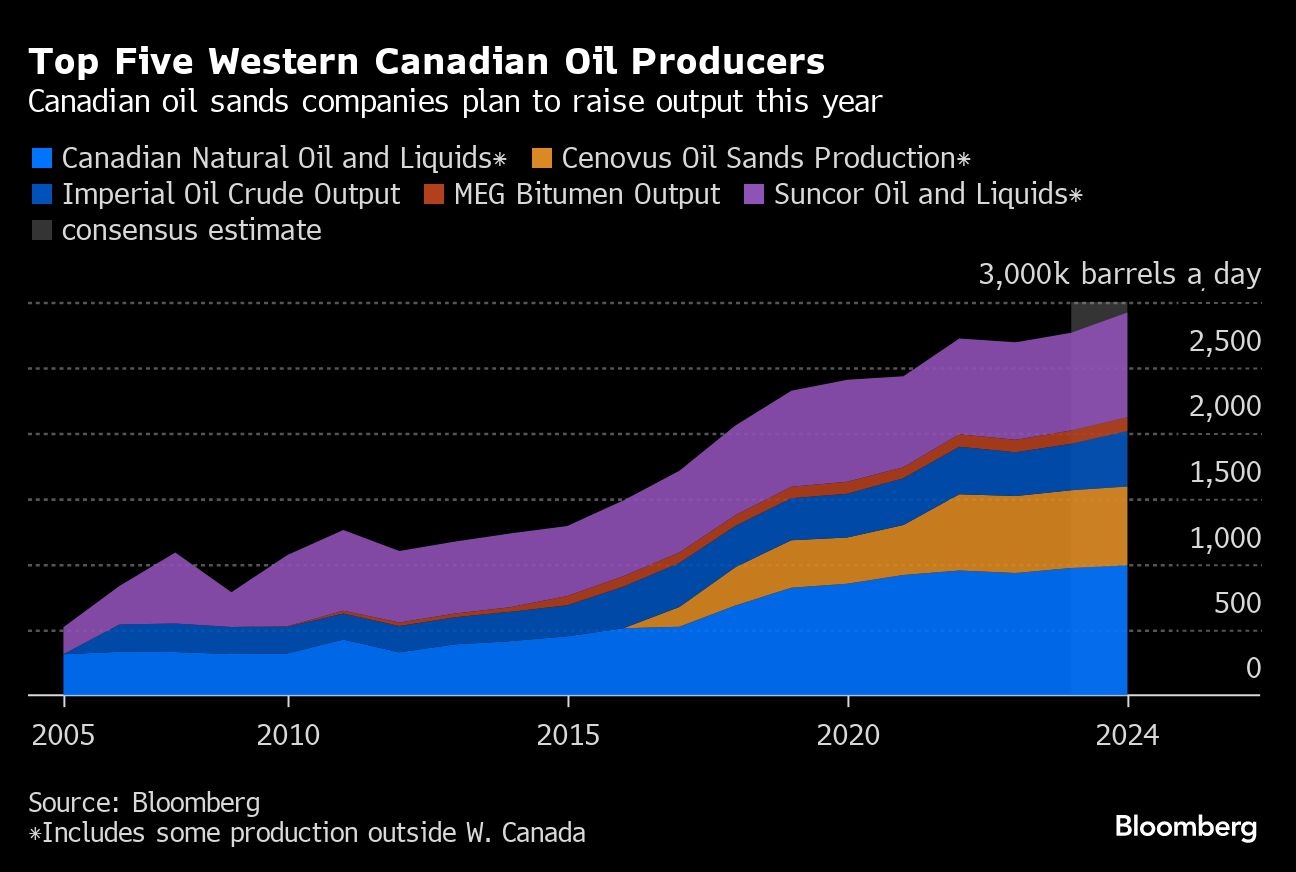

Canada’s oil producers are poised to pour about half a million barrels of new daily output — more than the total production of some OPEC members — into world markets over the next year or so.

And while the deluge of new crude will be a boon to an industry that has struggled to grow recently, it threatens to expand a global supply surplus and revive the pipeline shortages that have bedeviled Canadian drillers for years, something that could once again severely depress the price of the country’s oil exports.

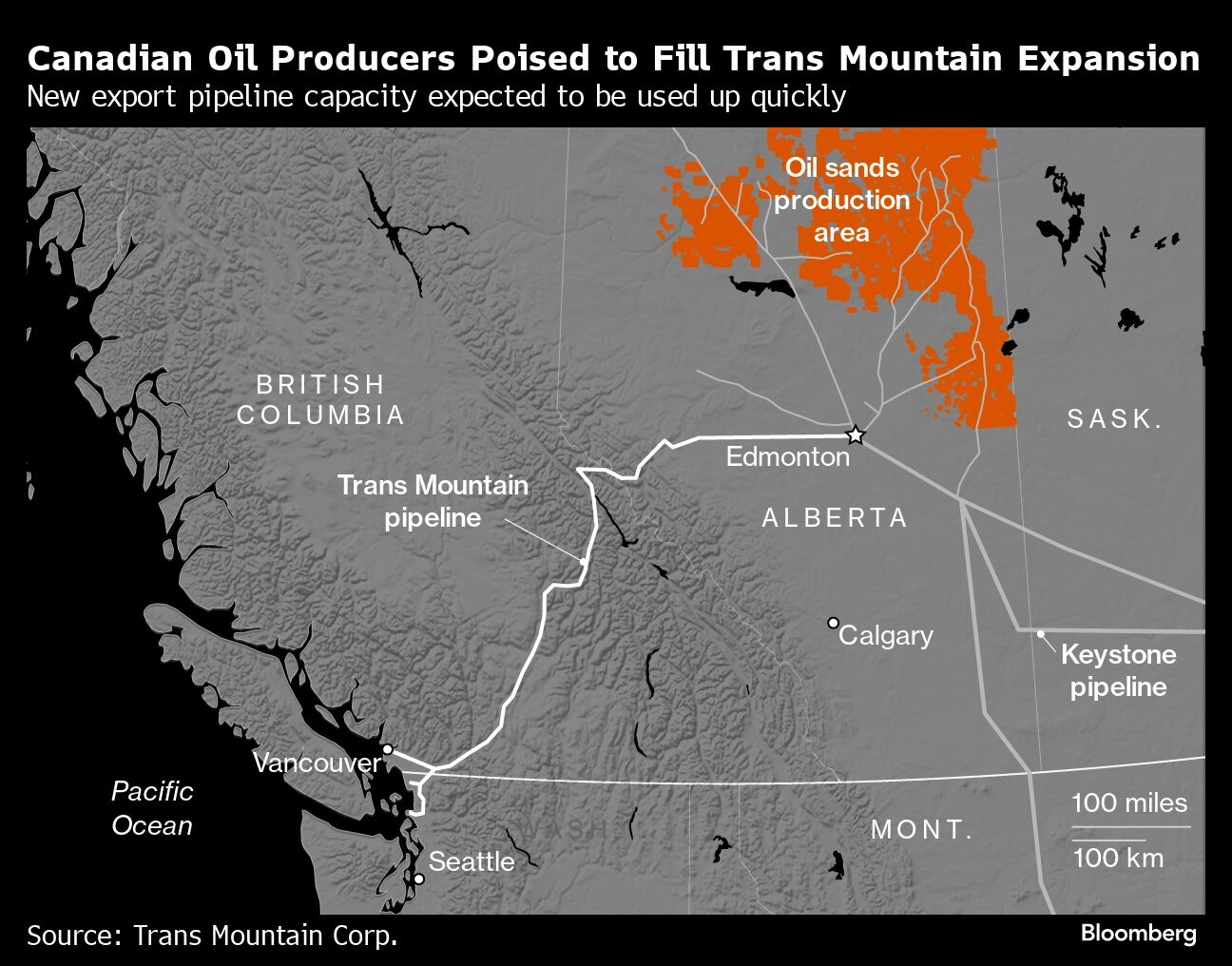

With an expansion of the Trans Mountain crude pipeline set to start operation in the months ahead, the supply of western Canadian oil available for export is set to rise by about 500,000 barrels a day by the end of next year, S&P Global estimates. The added volumes — which will include increased Canadian production and some imported condensate — will take up almost all of the 590,000 barrels a day of new capacity on Trans Mountain.

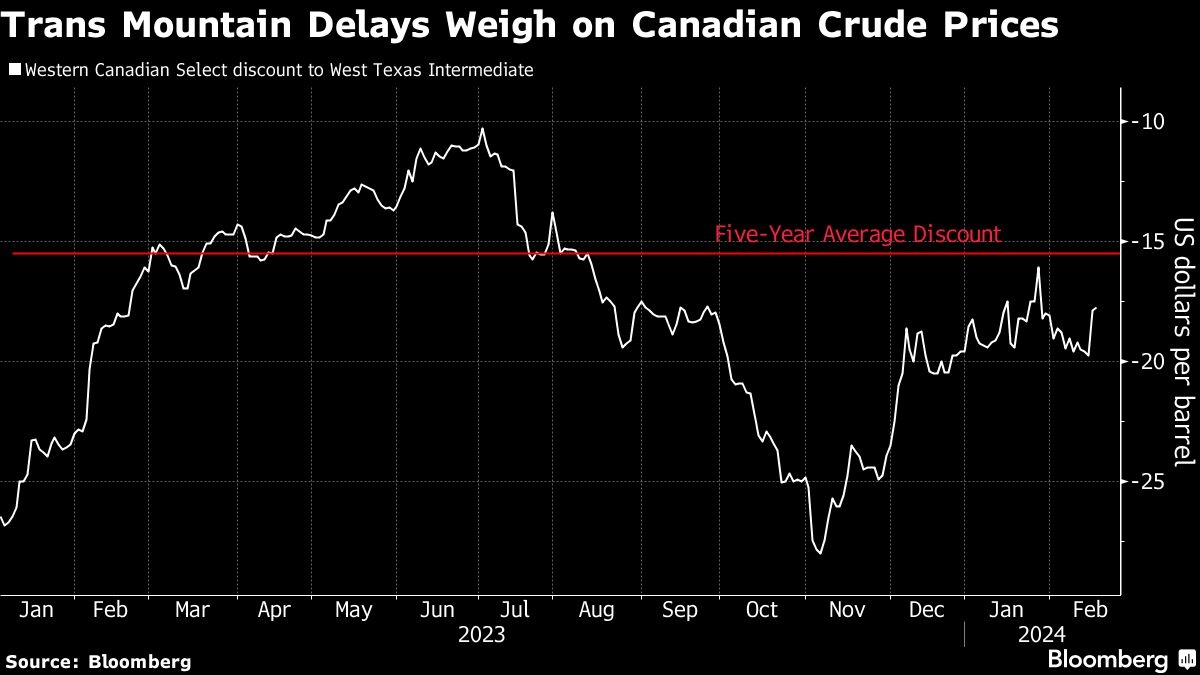

Much of that new output is already flowing out of Alberta’s oil-sands mines and wells as projects with long lead times come online, but the new space on Trans Mountain has been delayed by drilling challenges along the line’s route. The mismatched timing is straining already-full pipeline systems and weighing on heavy Canadian crude prices.

Trans Mountain “has become a just-in-time delivery system,” said Kevin Birn, S&P Global Commodity Insights chief analyst of Canadian oil markets. “Had it come on time when it was supposed to, Canada would have had some excess capacity.”

The Trans Mountain expansion already has been a decade in the making. The project — which twins an existing, 715-mile (1,150-kilometer) line running from Edmonton to the Pacific Coast city of Vancouver — was almost scrapped because of opposition from Indigenous groups and environmentalists in British Columbia.

Prime Minister Justin Trudeau’s government bought the pipeline to save it and provide the country’s producers with a way to sell their crude to markets in Asia. While construction has moved forward under the government, it’s years late and billions over budget.

But the government-backed company has recently held to projections that operations will begin in the second quarter. Drillers have boosted output in anticipation, sending Alberta’s oil output to records in both November and December, surpassing export pipeline space of roughly 4.2 million barrels a day.

The situation forced pipeline operator Enbridge Inc. to ration heavy-oil line space on its Mainline system by the most in more than two years in February. The volume of crude shipped out of Alberta on rail cars in November rose to the highest since June 2022.

Enbridge had feared Trans Mountain, known as TMX, would draw volumes away from the Mainline, but the company may have to continue rationing pipeline space even after Trans Mountain starts, Colin Gruending, president of liquids pipelines, said on a recent earnings call.

“This notion that the Mainline is going to lose a bunch of volume when TMX comes in is a bit of a stale concept,” he said. “It might have been valid a few years ago, but it has been delayed materially.”

The lack of pipeline has caused heavy Canadian crude’s discount to the U.S. benchmark to linger around US$20 a barrel for most of this year, wider than the average of about $15.50 over the past five years. The discount was $17.30 at the end of Tuesday, according to General Index prices.

For global markets, the extra Canadian output adds to a flood of new production from the U.S., Guyana and Brazil that’s complicating OPEC’s efforts to balance markets with its own supply cuts. The unexpectedly strong non-OPEC growth was a major factor in oil prices’ 11 per cent decline last year, and expectations that it will continue have helped keep crude in a narrow range this year despite rising tensions in the Middle East.

Canada’s new production also puts producers in a precarious position. If one pipeline goes down, crude can suddenly back up, forcing them to slash output or ship oil via more expensive rail.

That’s what happened in 2018, when a heavy U.S. refinery-maintenance season and scattered pipeline outages caused the discount on Canadian crude to blow out to $50 a barrel. The crisis subsided only after Alberta’s government ordered producers to cut output by 325,000 barrels a day to restore balance.

Alberta drillers plan to keep boosting output over the next two years. Imperial Oil Ltd. has plans to add more output in 2025, while Cenovus Energy Inc. is looking to boost production from its Christina Lake oil-sands site starting next year and at Foster Creek the following year.

“Everything is going to effectively be full,” S&P’s Birn said. But a return to the days of major pipeline shortages may be averted if production growth “really slows down” as S&P predicts it may.

“If we are wrong,” Birn said, “Western Canada may not have enough pipelines.”