Apr 24, 2024

China 2024 Growth Outlook Raised to 4.8%, Deflation Risk Lingers

, Bloomberg News

(Bloomberg) -- Analysts upgraded their forecast for China’s growth this year after a better-than-expected performance in the first quarter — but they see more signs that the world’s second-biggest economy will struggle to escape from deflationary pressures.

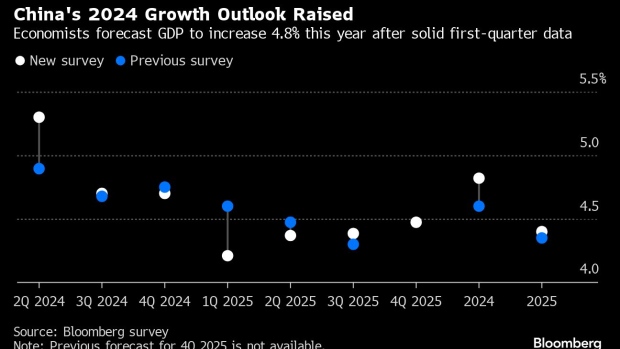

Gross domestic product is now projected to expand 4.8%, according to the median estimate in a Bloomberg survey of economists. That’s up from a 4.6% forecast in last month’s poll, and a tad closer to the government’s goal of around 5%.

Inflation forecasts were lower than in the March survey, pointing to a lasting weakness in household spending after a property crash. Consumer-price inflation is now seen averaging 0.6% in 2024, down from 0.8%. Industrial prices are expected to fall at an average 0.6% pace, double the March prediction.

The Chinese economy enjoyed a surprisingly strong start to the year, bolstered by overseas demand for its manufactured goods and Beijing’s push to develop advanced technologies. But much of the bounce came in January and February. Consumption lost momentum in March and the housing slump deepened — pointing to challenges for the rest of 2024 that may require more stimulus to address.

“Real estate and its upstream and downstream sectors are shrinking across the board, constantly driving down social expectations as well as overall demand,” said Nie Wen, chief macro analyst at Hwabao Trust Co. “Government investment is urgently needed to stabilize or boost demand.”

The property downturn poses the biggest risk to China’s growth this year, according to nine of the 15 economists surveyed, while four said low inflation and weak domestic consumption are the biggest concern. There was a similar split on how Beijing should respond, with measures to bolster real estate investment topping the list, followed by an acceleration in public spending.

Local governments in particular have been cutting back their outlays because many are grappling with a debt crisis. After years of rampant off-balance-sheet borrowing, they’re now getting hit by falling income from taxes and land sales.

Beijing has announced plans to step up central government spending as an offset. But government bond issuance has been slower than expected, partly because authorities were still looking for ways to invest the funds they raised last year, amid a lack of qualified projects.

Officials have indicated that debt sales could pick up in the coming months, opening the way for a fiscal boost. The National Development and Reform Commission, China’s top economic planning agency, said Tuesday that authorities have finished screening projects requiring a total investment of 5.9 trillion yuan ($814 billion) that qualified for special local-bond funding. The commission called it a “solid foundation” for using the 3.9 trillion yuan of those bonds that are due to be sold this year.

The Communist Party’s most senior 24 leaders are expected to convene later this month at the Politburo meeting, which is closely watched by investors for clues to how economic policy may shift in the coming months.

Other highlights of the survey

- The median forecast for year-on-year GDP growth in the second quarter is raised to 5.3% from 4.9% in the previous poll

- Exports are expected to expand 3.4% this year, vs 3%. Import growth outlook is maintained at 2.6%

- Retails sales are now estimated to increase 5.5% this year, vs 5.7%

- Fixed-asset investment is forecast to rise 4.8% in 2024, vs 4.6%

- The People’s Bank of China is seen lowering its reserve requirement ratio by 25 basis points in the current quarter, a cut that was previously not expected till the third quarter

- The PBOC is seen lowering the rate on its medium-term lending facility by 10 bps before the end of June, then another 10 bps in the fourth quarter

©2024 Bloomberg L.P.