Apr 10, 2024

China Vanke Tumbles to Decade Low as Manager Probe Adds to Woes

, Bloomberg News

(Bloomberg) -- Shares and bonds of China Vanke Co. extended declines in afternoon trading as the developer said a regional manager in the city of Jinan was assisting an investigation.

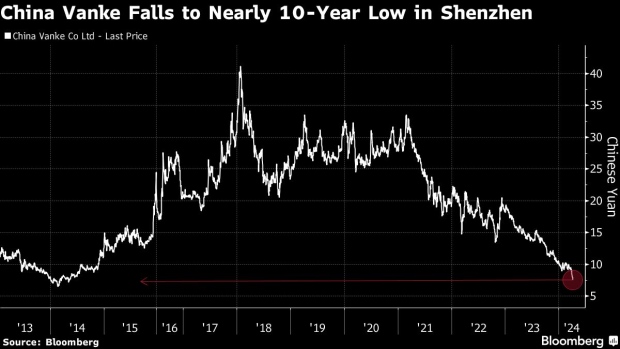

The stock closed down 5.1% in Shenzhen at its lowest level since May 2014, while shares traded in Hong Kong lost more than 4%. A regional manager, Xiao Jing, is cooperating in a probe over “personal reasons,” the company’s Jinan unit said.

While Vanke offered few details, the news came after the developer denied allegations made by some Shandong-based partner companies over the company and its chairman. The accusations included money laundering and tax evasion.

The stock’s sudden decline Wednesday afternoon shows fragile sentiment toward the developer, which has come under increased scrutiny by investors. As sliding sales wallop profits and deepen liquidity pressure, credit agencies have cut ratings for the state-backed builder to junk territory on concerns about its debt repayment capabilities.

“The investigation news is definitely negative for the stressed developer as investors are observing whether the well-known developer could survive under current sales downtrend,” said Shujin Chen, an analyst at Jefferies Financial Group. “It’s also an important factor to judge its default risks, thus may cause relatively large fluctuation of stock prices.”

The builder’s dollar note due in June trades at around 95 cents on the dollar, signaling strong expectation for timely repayment. Yet notes due in 2027 fell 3.3 cents to 43.7 cents as of 4pm Wednesday, a distressed level showing deep credit concerns over mid-term payments.

--With assistance from Yuling Yang and Emma Dong.

©2024 Bloomberg L.P.