Apr 15, 2024

Codelco Eyes Partnerships to Help Boost Ailing Copper Production

, Bloomberg News

(Bloomberg) -- Codelco is exploring more partnerships with the private sector as Chile’s state copper behemoth looks to recover from a production slump and surging debt.

Chairman Maximo Pacheco expects “some conclusions” this year from teams negotiating an operational tie-up between its Andina mine and Anglo American Plc’s adjoining Los Bronces, he said Monday in an interview. Codelco already has an indirect stake in Los Bronces, shares ownership of the El Abra mine with Freeport-McMoRan Inc. and is negotiating with would-be lithium partners.

“New projects and new partnerships are part of the essence of what we do in Codelco,” Pacheco told Bloomberg from Santiago, which is hosting one of the world’s largest copper industry events — Cesco Week and CRU’s World Copper Conference.

While there’s no talk of private sector ownership of Codelco or its main mines, which would require congressional approval, the company has been pursuing joint ventures to develop new projects and improve operational efficiency.

Mining companies around the world are forging partnerships to bring down costs and boost output as mines and projects get trickier and pricier at a time of lingering supply-chain disruptions, inflation and heavy permitting. For Codelco, arrangements to squeeze more out of existing operations or share risk and investments would be of particular appeal given it’s producing at the lowest levels in a quarter century, jeopardizing its status as the world’s No. 1 supplier.

A possible operational collaboration at Andina-Los Bronces would be focused on tapping rich ore sitting between the two mines as well as sharing processing plants.

“We have tremendous opportunities that we can develop jointly,” Pacheco said.

London-based Anglo declined to comment on the talks.

The plight of Codelco is a focal point at Cesco Week, given concerns that there may not be enough supply of the wiring metal to meet the needs of the energy transition. Copper futures on the London Metal Exchange have rallied this year to 22-month highs amid signs of supply stress and improving factory activity from the US to China.

Much of the state-owned company’s woes are due to delays and budget blowouts at four giant projects, which the company says are essential to reverse its declining production. Pacheco attributed the company’s struggles with its projects to investment procrastination that led to previous management opting to develop the four projects simultaneously, a juggling act he said “was not a good idea.”

New Chief Executive Officer Ruben Alvarado has shaken up management in a bid to bring late and over-budget projects onstream, with the company aiming to get back to pre-pandemic levels of about 1.7 million tons by the end of the decade. Still, management is revising budgets and schedules at a project at El Teniente mine, citing geomechanical conditions, the effect of glaciers and cost underestimates.

Pacheco insists Codelco is turning the corner despite signaling a drop in first-quarter production. Earlier this month, he told lawmakers that output was “almost 300,000 tons” in the first three months of this year, or 99% of an internal target. But that would be well below what the firm reported for the same period a year earlier, which was 326,000 tons from its fully owned mines, and a total of 352,000 tons.

Pacheco said that the drop in first-quarter production was the result of lower grades, which had been anticipated as part of the company’s production plan.

To reach its annual production guidance of 1.325 million tons to 1.39 million tons, Codelco is betting on ramping up those under-performing projects in coming quarters. Production could drop precipitously if it fails to execute the ambitious pipeline, which includes a $4 billion to $5 billion outlay this year alone.

Under the current arrangement with Chile’s government, Codelco can reinvest 30% of its annual profits, with remaining funding having to come from bond issuance. The company sold $3.4 billion in bonds last year and $1.5 billion so far this year, according to data compiled by Bloomberg. Whether or not it returns to the debt market again this year “will depend a lot on copper price and on production and rates of interest,” Pacheco said.

The government has no plans to introduce new funding mechanisms for Codelco, given the 30% profit retention has only been in force for two years and its prospects are improving, Finance Minister Mario Marcel said late last month. He said any additional decisions would depend on new projects the company develops.

Those possible projects are worth “tens of billions” of dollars, Codelco’s Pacheco said.

Read More: Codelco Sees Slow Recovery After Years of Copper Output Declines

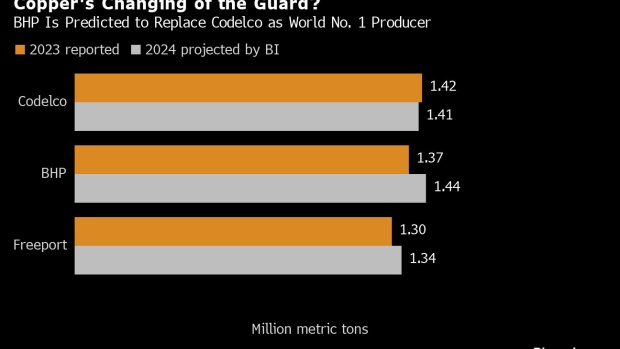

According to Bloomberg Intelligence, Codelco will fail in its bid to boost output this year and will give up its mantle as world No. 1 supplier to BHP Group. Still, Codelco should recoup the top spot in the years ahead.

“The market continues to believe in us as a company because the promise we made was we are going to build the Codelco of the next 50 years — and we are doing so with some delay,” Pacheco said.

©2024 Bloomberg L.P.