Aug 4, 2016

CP Rail stock falls as Pershing Square's Ackman sells stake

BNN Bloomberg

The architect of arguably the fiercest activist campaign ever staged in Canada is ready to cash out of his investment.

Bill Ackman's Pershing Square Capital Management said late Wednesday in a news release it will sell its remaining 9.8 million-share stake in Canadian Pacific Railway Ltd (CP.TO).

CP Rail's stock was down more than 3.22 per cent to $186.30 in afternoon trading on Thursday.

The hedge fund launched a shareholder proxy battle to turn the then-underperforming railroad around in 2012 after disclosing its initial stake the previous fall. The fight for shareholder support pitted CP's board, populated by some veterans of the Canadian establishment, against a no holds barred-style of activism that Canada wasn't accustomed to. Ultimately, Ackman prevailed -- and his successful proxy campaign also brought former CN Rail CEO Hunter Harrison into the fold as CP's new Chief Executive Officer.

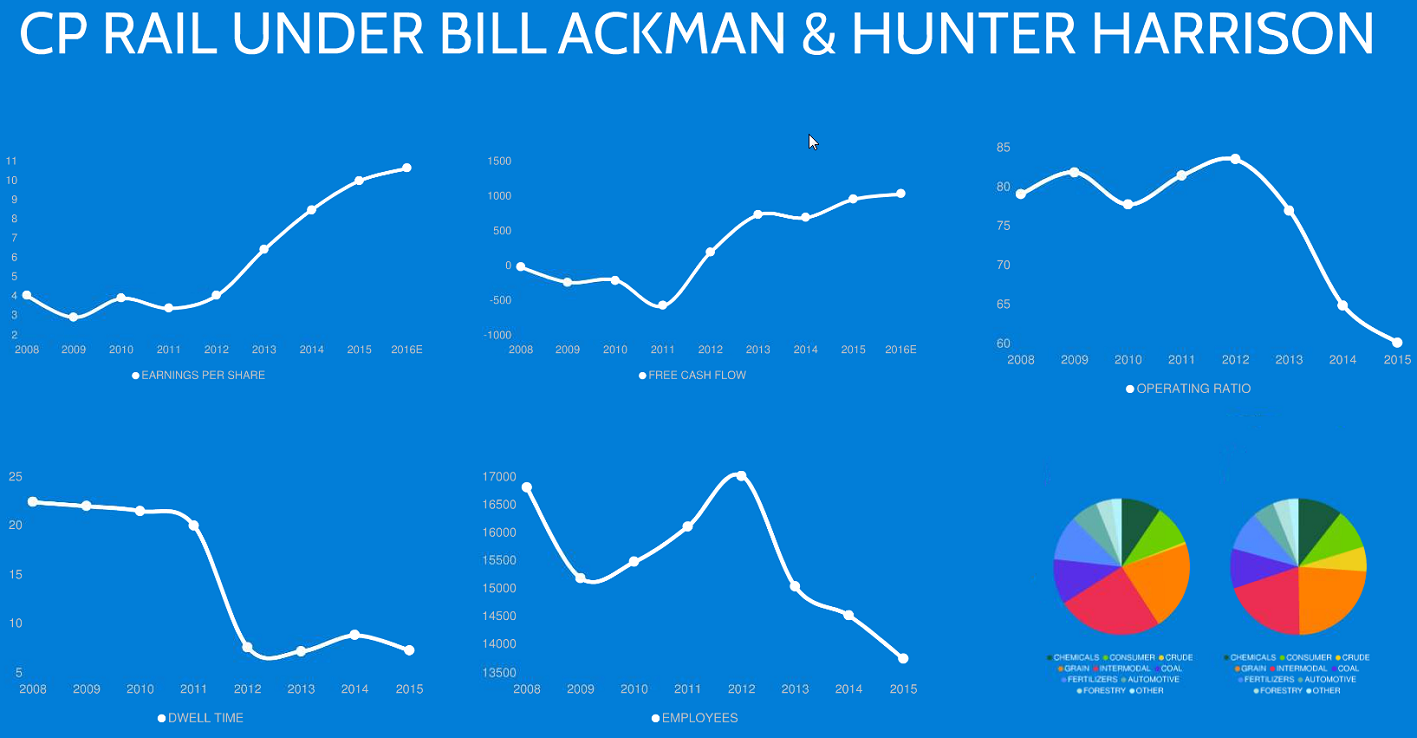

"Canadian Pacific has completed an incredible transformation since our initial investment in 2011," Ackman said in a statement. "Hunter Harrison and Keith Creel have restored to greatness one of North America's top railroads and have set the company on the path to continued success."

Ackman, who has served on CP's board of directors since 2012, said on Wednesday he plans to remain on the board until CP's next annual general meeting.

J.P. Morgan, Credit Suisse and BofA Merrill Lynch will act as underwriters for the offering, said the release by Canadian Pacific and Pershing Square.

While Canadian Pacific will go down as one of Ackman's big winners, he is currently known more for his fund's losers - namely his investment in Valeant Pharmaceuticals International (VRX.TO), which he made in 2015 and which has cost his investors billions in paper losses as the stock price crashed 91 per cent in the last 52 weeks.

Pershing Square said it plans to use the proceeds from the divestment of its stake in CP "to fund one or more new investments."

With files from Reuters