Apr 20, 2016

CP’s CEO: Our M&A plan was foiled because we’re a Canadian company

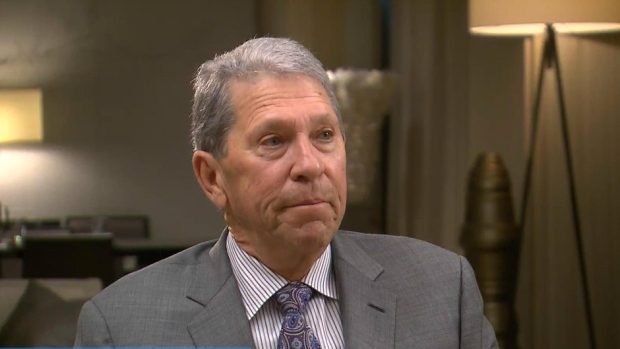

Canadian Pacific Railway’s chief executive officer isn't mincing words on what doomed his bid to buy Norfolk Southern. Hunter Harrison opened up on BNN Wednesday about the political fireworks that he sparked with CP’s takeover campaign in the United States.

Harrison argues he was “clearly” at a disadvantage in winning regulatory approval for the proposed purchase of Norfolk because CP Rail is a Canadian company, and he believes it would have been more politically palatable in the U.S. to see a major American railway turn the tables on CP.

“The politicians started writing letters, they became experts on mergers and consolidation,” Harrison told BNN about the political uproar over CP’s bid for Norfolk, “That’s what you get out of a political process.”

With M&A on the backburner, CP rewarded its shareholders on Wednesday by boosting its quarterly dividend 43 per cent and launching a new share buyback program.

The railway will now pay a quarterly dividend of 50 cents per share, up from 35 cents.

In addition to the increased dividend, the railway said it may buy back up to 6.91 million of its shares or roughly five per cent of its "public float" of shares under its normal course issuer bid.

Harrison told BNN the buyback and dividend sweetener should be a “pretty good signal” that CP isn’t planning any other takeover talks right now. But that’s not to say the company is giving up on its ambition to consolidate the industry. Harrison’s contract is set to expire next year and the presumed CEO-in-waiting, Keith Creel, isn’t expected to rip up the M&A playbook.

“I think he believes in the [M&A] cause,” Harrison said about Creel. “He understands the Chicago [bottleneck] issue. He understands what we’re trying to accomplish.”

Harrison added he thinks CP has a winning formula that Creel can build upon.

“He’s an exceptionally talented young man – probably the brightest operating mind in North America,” Harrison said. “I think I’m going to leave [CP] in pretty good hands.”

For its first quarter, the company said it earned $540 million or $3.51 per diluted share, up from a profit of $320 million or $1.92 per diluted share a year ago.

On an adjusted basis, the railway reported a profit of $384 million or $2.50 per diluted share for the quarter, up from an adjusted profit of $375 million or $2.26 per diluted share a year ago.

Revenue slipped to $1.59 billion compared with $1.67 billion in the first three months of 2015.

CP also reported that its operating ratio, which tracks operating expenses as a percentage of revenue, improved to 58.9 compared with 63.2 per cent a year ago.

"The precision railroading model works in all economic environments," CP chief executive Hunter Harrison said in a statement.

"Despite weakness in the economy and volume headwinds, we focused on what we can control -- our costs and our commitment to providing reliable service -- and delivered a record performance."

Last week, CP gave up its attempt to merge with Norfolk Southern Corp. after the U.S. Justice and Defense departments raised concerns about the proposed takeover.

The Calgary-based railway had proposed the deal in November, which would have created the largest railway in North America.